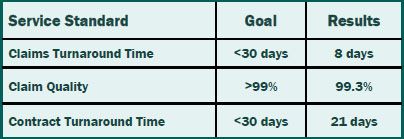

We set standards for ourselves so you can reap the benefits of timely and accurate service. Our claims and contracts staff prides themselves not only on meeting the service standards, but also consistently exceeding the standards.That means you can rely on timely and accurate service from Summit Re so you can concentrate on your business without worries about your reinsurance.

Swiss Re Purchase of ERC

On June 10, 2006, Employers Reinsurance Corporation (ERC) was acquired by Swiss Re. Both Summit Re and ERC are excited about this business transaction, as it will increase our ability to provide you with the best financial security, expertise and service in the reinsurance industry. The transaction includes all of the Commercial Insurance operations of Employers Reinsurance Corporation. Swiss Re specifically sought to include the HMO reinsurance and employer stop loss product lines in this transaction and has plans to grow the Commercial Insurance operations.

Effective with the closing, the senior management of the Commercial Insurance division of ERC will remain in place, including Robin Sterneck, President, and Jeff Argotsinger, Vice President and medical excess product manager.

ERC, as a part of Swiss Re, will provide our customers with even more customized solutions. As a company focused solely on insurance and reinsurance risk worldwide, Swiss Re recognizes the value of building and growing customer relationships for the long term. Swiss Re is now the world’s largest reinsurance company in both property/casualty and life/health business.

As part of the transaction, General Electric, the former parent of ERC, has acquired 9% of Swiss Re shares and will have a board seat. GE is essentially taking a smaller share in a larger operation.

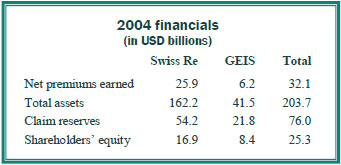

With this acquisition of ERC, Swiss Re took a strong balance sheet and made it even stronger. ERC is currently rated A by AM Best, and Swiss Re is A+. Below is a summary of the financials of the combined operation (2005 results were not yet available).

Summit Re and ERC have a long term agreement to underwrite catastrophic medical excess reinsurance together. We look forward to the opportunity to provide HMOs and other managed care plans with reinsurance through our exclusive relationship with ERC. Swiss Re management has re-approved our marketing plan, pricing / underwriting manuals and guidelines.

If you have any questions, please feel free to contact your Summit Re Regional Vice President or call Brian Fehlhaber at 260-469-3004.

Best of Both Worlds: Self-Funding and Managed Care

To control the rising costs of providing a medical benefit program, some employers look to self funding. HMOs that can offer administrative services only (ASO) or affiliate with third party administrators (TPAs) can bring both a self-funded approach and managed care programs to employers.

Selecting an MGU

HMOs who participate in the employer stop loss market should carefully select a managing general underwriter (MGU) with expertise in both managed care reinsurance and the self-funded market. Your MGU should also have full-service capabilities. Summit Re is a full-service MGU focusing on HMOs who participate in the employer stop loss market. Our managed care experience sets us apart from traditional employer stop loss carriers and managing underwriters.

Pricing and Underwriting

Summit Re’s staff of underwriters and actuaries is dually equipped to understand this combination of funding and managed care savings. We apply our knowledge in the development of competitive stop loss rates and aggregate funding factors for your self-funded clients. As one of the market leaders in HMO excess reinsurance, we have a unique understanding of HMOs and their excess medical risk. We review not only your provider contracts, but also your managed care protocols and your HMO experience.

Sales Support

Summit Re takes an active role in helping you place self-funded business. We are a phone call away to discuss strategy on individual accounts. In unique situations, we can assist you in the on-site presentation of the stop loss proposal to the employer. Once a group is sold, we focus on servicing the account.

Integrated Administration

Our rating and proposal system is fully integrated with our stop loss contract production, premium collection, and claims payment modules. This results in proposal-based policy issued quickly, accurate premium accounting, and timely claim payments. We also have an experienced staff in each functional area to ensure that personalized service isn’t forgotten.

Risk Transfer Flexibility

Summit Re works with two carriers who provide the employer stop loss product: Companion Life Insurance Company and Presidential Life Insurance Company. These two carriers allow Summit Re to write this product in all 50 states.

If you want to retain some of the risk but do not have an insurance company, there are certain approaches we can use that allow you to assume a portion of the risk written by one of our insurance company partners and managed by Summit Re.

If you have an insurance company to write the employer stop loss product, your carrier can keep some or all of the risk. Summit Re can provide some or all of the MGU services, or your insurance company can perform all the functions with Summit Re providing consulting services in specific areas.

Summit Re’s goal is to be creative, responsive and entrepreneurial, to help you meet your strategic goals for employer stop loss, whatever they may be!

Clinical Notification Triggers

The clinical notice form should be used by the medical management staff to notify Summit Re of potential cases where Summit ReSources may be of assistance to you. Use the clinical notification triggers list as a guide. The list is not all inclusive, so feel free to submit a clinical notification on any case for which Summit Re may be of assistance to you.

Diagnosis

- High cost pharmacy, such as Flolan, Factor VII, Factor VIII, Cerezyme / ICD-9: 272.7, 286.0, 415.0, 416.0, 416.8

- Major burns with a potential for a prolonged hospitalization / ICD-9: 941.0, 942.0, 943.0, 945.0, 948.2-9

- ESRD/dialysis with monthly dialysis costs greater than $10,000 / ICD-9: V56.0, V56.8, V45.1

- Major injuries or multiple trauma with a potential for a prolonged hospitalization and/or acute rehabilitation admission

- Premature infants with one or more of the following:

- gestational age ≤ 24 weeks / ICD-9: 765.0

- severe congenital heart disease, e.g. hypoplastic left heat, Tetralogy of Fallot, etc. / ICD-9: 746.7, 746.01, 746.89, 745.2

- severe gastrointestinal anomalies, e.g. gastroschisis, omphalocele, necrotizing enterocolitis, short bowel syndrome, etc. / ICD-9: 756.79, 777.5, 777.8, 579.3, 756.79

- severe bronchopulmonary dysplasia requiring long term ventilator treatment / ICD-9: 770.7

Case Characteristics

- Out of network services with minimal or no negotiated discounts

- Billed charges that greatly exceed reasonable and customary for the services rendered – refer before the claim is paid

- Questionable charges, such as unbundling or experimental treatments

- Cases with the potential to exceed the reinsurance deductible

- Multiple inpatient stays

Submission Process for Clinical Notices

- Use the clinical notification triggers list as a guide for completion of clinical notifications submitted to Summit Re.

- It is recommended that the clinical notices be submitted from the medical management department as they are usually the department first notified of a request for services.

- Complete the Clinical Notification Form (all sections that apply to your case).

- Completed forms may be faxed to 260-469-3014, emailed via encrypted software to claims@summit-re.com, or mailed to Summit Reinsurance Services, 7030 Pointe Inverness Way, Suite 350*, Fort Wayne, IN 46804.

- In lieu of the clinical notification form, you may submit a report containing similar information.

*Address updated when this article was converted to this post in 2014.

Early Intervention Goal of New Clinical Notice Process

To better assist you in managing your risk and to minimize paperwork, Summit Re has significantly revised the notification process for high cost, catastrophic cases. The main goal of the revised process is to help you manage your risk while there is an opportunity to intervene. Under the current HMO reinsurance agreements, clients are required to notify Summit Re of members whose eligible expenses have reached 50% of the deductible. Currently, Summit Re receives the majority of the 50% notices from finance or claims departments. By this time, the claims have already been paid by you, and it is usually too late to implement any additional interventions that may help mitigate costs, as illustrated in the two examples below.

Summit Re will no longer require submission of a 50% notice report from the finance/claims area. Instead, we are requesting clinical notices from the medical management department. The clinical notices will be much more actionable, since services may still be in the pre-service negotiation phase, the case may be undergoing concurrent review and claims have not yet been paid.

As reinsurance agreements are renewed, the language regarding 50% notices will be revised to reflect the new process. The revised referral trigger list (CLICK HERE) keeps the focus on situations where Summit Re may be of assistance to you.

Medicare Revenue Recovery ReSource

Medicare reimbursement is one of the top issues that our clients face, so we’ve identified a unique way to make your Medicare revenue recovery much less of a headache.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Morbidity-based payments

The Medicare Advantage program operates under a diagnosis-based risk adjustment system that pays higher monthly capitation rates for enrollees with higher morbidity levels. Diagnosis codes extracted from medical claims are submitted to Centers for Medicare and Medicaid Services (CMS). CMS uses these diagnoses to assign enrollees to disease categories. The problem is that medical claims often do not reflect the enrollees’ true morbidity:

- Only a fraction of the diseases and conditions documented in the medical record ever make it to the claim form or record submitted to the health plan.

- New enrollees often have inadequate claims information.

- Inadequate diagnosis coding is common because diagnosis codes rarely factor into the claims adjudication process.

Every disease not submitted to CMS that is included in the CMSHCC (Hierarchical Condition Categories) model represents lost revenue. This lost revenue is most acute for patients with comorbidities, who are likely to require a disproportionate share of your resources.

Lost Opportunity

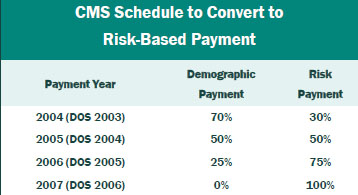

If you have not reviewed medical records for additional HCCs in the past two years, you may have given up significant revenue. The portion of the capitation payment attributable to medical diagnosis is being phased in by Medicare Revenue Recovery ReSource CMS through 2007, at which time 100% of the premium payment will be risk based. The table gives the transition schedule.

Results

Working closely with your staff, Beam clinical staff assesses data and medical charts to maximize recovery of lost premium. The results can be substantial. Based on its experience, Beam Partners estimates recoveries of about $3 million for every 10,000 members in the Medicare plan. Therefore, for plans with 25,000 members, approximately $7.5 million of additional recoveries is typical.

Contact: Your Summit Re account manager or Brian Fehlhaber, VP, Sales and Marketing at 260-469-3004 or bfehlhaber@summit-re.com.

Schedule an Inhouse Case Management Seminar

To help your staff keep current with case management trends and standards of practice, Summit ReSources is offering a free case management seminar. This seminar has been approved for 3.5 contact hours by the Commission for Case Manager Certification (CCMC).

The seminar topics include standards of practice, trends in case management and benefits of case management. We will also personalize the seminar by discussing the successes and challenges of your case management program.

Summit Re clients can schedule the free seminar for their teams by contacting:

Debbie Stubbs, RN, MS, CCM, Managed Care Specialist 260-407-3979 / dstubbs@summit-re.comInformation-Based Decisions with TransAdvise

URN’s TransAdvise is a new complimentary service for our clients who have contracts with URN. TransAdvise clinical consultants can assist you and your members by providing information about transplant-related diagnoses and treatment options. A dedicated team of transplant nurse experts who work with more than 12,000 transplants each year are available to provide:

- Transplant program performance information (e.g. annual volumes and outcomes) to help patients make more informed decisions about their transplant care.

- Information about relevant clinical trials and treatment protocols based on diagnosis or underlying condition.

- Assistance in referral to Transplant Centers of Excellence Network programs to maximize clinical and financial outcomes.

These services help you and your members make more informed decisions about transplant care with the goal of better outcomes.

Access to TransAdvise is direct, flexible, easy, and free to our clients. Simply call (800) 343-4305 to speak with a TransAdvise clinical consultant or provide this number directly to your members. TransAdvise clinical consultants are available from 7:00 a.m. to 6:00 p.m. CST, Monday through Friday. Conference calls with a TransAdvise clinical consultant are also available for you and your members.

Summit Re/URN Transplant Program

The Fall (October) 2005 edition of Summit Perspectives detailed Summit Re’s new transplant program features with United Resources Networks (URN). Some key points to keep in mind regarding the program are:

- URN access fees are discounted for transplant services on business reinsured through Summit Re. These discounts are not available by directly contracting with URN or through any other reinsurer.

- URN will extend the Summit Re discount fee arrangements to a new Summit Re client who was using URN through another reinsurer.

- A Summit Re client does not have to use URN exclusively in order to obtain the discounted access fees for transplant services where URN is utilized on business reinsured through Summit Re.

- Zero Access Fees (ZAP) is an exclusive URN arrangement with Summit Re. It provides for alternative transplant facility terms with no access fees. These terms can be elected on a case-by-case basis at the time of each transplant referral.

Please contact Debbie Stubbs RN, MS, CCM at dstubbs@summit-re. com if you have any questions or would like additional information concerning the Summit Re/URN Transplant Program.

Manage Your Transplant Risk More Effectively with New Program

Selecting a Network The most important consideration when choosing a transplant network should always be the quality of care delivered. A secondary but important consideration is the cost effectiveness of the network. A network that charges access fees but has greater net savings overall due to more favorable negotiated arrangements with network facilities is preferable to a transplant network that charges no access fees but has less effective contracts.

New Program

Summit Re recently conducted a thorough assessment of three transplant networks. (See table on page 3.) As a result of that assessment, we concluded that United Resource Networks (U.R.N.) provided the best overall value. Therefore, we agreed to enter into an exclusive arrangement with U.R.N. for the provision of transplant services for our clients. We have been able to negotiate lower access fees because of this exclusive relationship.

Access Fees

Under the new program, our clients will have their access fees for each transplant reduced by 5% due to Summit Re’s exclusivity with U.R.N. An additional 5% reduction can be realized if clients incorporate certain benefit incentives into their plan designs for the use of U.R.N. facilities and use them exclusively. A third discount is based on Summit Re’s total volume of business with U.R.N.

Make the Change

This program replaces the previous benefit that Summit Re had negotiated with U.R.N. – namely, a waiver of the 35%-of-savings fee U.R.N. normally charges for cases that access U.R.N. facilities but do not result in transplantation. The current program is still available to existing Summit Re clients who access U.R.N., but we recommend the new program. Summit Re will contact current clients to discuss the program in greater detail.

Access Fee Discount |

Source |

| 5% discount | Summit Re’s exclusive marketing of U.R.N. for transplant services |

| 5% discount | Client’s exclusivity agreement and benefit differentials |

| Up to 10% | Summit Re’s total volume of business with U.R.N.* |

Total Discount: Up to 20% |

|

*This portion of the discounts will be calculated retrospectively by U.R.N. on an annual basis. The discount is available to clients who have reinsurance coverage through Summit Re that is in effect on the date of the payment to Summit Re.