Healthcare reform will continue to require more responsibility from employers – especially small employers – which will, in turn, require more oversight by insurers. If employer groups are not properly enrolling, verifying eligibility, and reporting members, the health plan could find itself at risk with its reinsurer. The best way to avoid potential conflicts is to make sure your master contract is clear – and then to enforce it.

Read moreInsights into large claims

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. An insight is the act or result of comprehending the inner nature of things or seeing intuitively (Webster’s dictionary). This is a good description of what takes place in a Summit Re InSight analysis.

We often have a better perspective for viewing this inner nature of a large claim, since we only deal with coverage for large claims. Your staff must spend a majority of their efforts in areas that involve smaller and much more frequent claim events. This case study is an example of how an InSight analysis conducted by Summit Re helped a plan gain a better view of the inner nature of its catastrophic claims.

Situation: An increase in large claims

ABC health plan, located in a large metropolitan area, focuses on Medicaid members, specifically AFDC/TANF eligible members. AFDC/TANF membership is primarily composed of mothers and their children, and the majority of the large claims for this population involve premature infants or other infants with significant problems at birth. For this reason, the large claims from these situations are primarily from inpatient hospital confinements at facilities equipped to treat infants who are severely premature or have other critical problems. ABC health plan was seeing an increase in large claims from this population.

Cause: Reimbursement structure

ABC health plan utilized strong DRG contracts for most facilities in its state. The exception to this was for facilities classified as children’s hospitals. These facilities were considered in a unique category by the state for its Medicaid reimbursement methodology, and the plan was simply following the state’s lead for reimbursement. These types of facilities were paid on a percentage of billed charges determined by the state.

The state’s intention was to recognize these facilities as unique, and the state therefore concluded that the DRG reimbursement was not appropriate given the level and type of services the children’s hospitals were providing. What that meant for ABC health plan was that its most severe and highest cost claims were often being reimbursed at a percentage of billed charges. In this instance, the plan had little ability to contractually modify this reimbursement, although that was certainly an option for the plan to explore.

The reinsurance implication

How did these circumstances translate to the health plan’s needs for catastrophic medical excess reinsurance coverage? The plan had been purchasing coverage with a relatively low average daily maximum limitation for inpatient hospital services because of a mistaken perception that the strong DRG reimbursements at many facilities and deep discounts at children’s facilities were protecting it from all risk except for the exceptionally long hospital stays. In reality, the facilities being reimbursed at a percentage of charges had been rapidly raising their rates and, despite the presence of deep discounts, the plan was experiencing average per-day charges on many large claims well in excess of its average daily maximum limitation for inpatient hospital services. This meant that the plan was absorbing a great deal of variability from large claims due to payments at very high costs per day.

Options

Now that the plan recognized the circumstances under which it was operating for many large claims, it could now consider the options for managing the risk. Re-contracting with children’s hospitals in its service area at more favorable terms would, of course, be a wonderful solution since it could be structured to significantly reduce the plan’s overall risk. In this instance, however, the plan was not in a position to implement such a provider contracting change. This course of action could certainly be considered in the future.

What could be restructured easily was the reinsurance coverage so that it would provide more coverage for high cost days. The best and most immediate solution for this plan was a higher average daily maximum limitation for inpatient hospital services, coupled with a slightly higher deductible. This allowed the plan to exchange reinsurance premium dollars for better reinsurance reimbursement for both long-stay and high cost-per-day hospital risk.

Although these changes may seem obvious to the party reviewing large claims day in and day out, they were not at all intuitive to the plan’s management staff, who had been spending a majority of their time and effort managing the everyday activities and finances of a health plan. It is, in fact, the purpose of the InSight analysis to bring these circumstances to the forefront when they otherwise would remain hidden in the day-to-day activities of the plan.

What are you, Summit Re?

“What is Summit Re, a broker?” ask some individuals in the industry who haven’t worked with us before. Technically, we are regulated as a Reinsurance Intermediary Broker, which is very different from the retail broker you may have dealt with before. We place reinsurance for health plans, but only for ERC/Swiss Re. And we do so much more: we’re responsible for underwriting each risk, developing and maintaining underwriting and pricing manuals, drafting contracts, processing claims and premium payments, servicing accounts, and maintaining managed care vendor relationships.

The health plan reinsurance marketplace is divided roughly in half between coverages that are delivered directly, which is the way we do business, and those placed through brokers. Which is better? Competition keeps all of us on our toes, but here are reasons we prefer direct distribution.

Deal directly with the decision-makers

Your Summit account team doesn’t just sell a coverage, it prepares and delivers the contract language, pays claims under that contract, and works with your medical management team to reduce current and future medical expenses.

Short distribution chain, low expenses

ERC/Swiss Re retains the risks it writes, so there are no back-end pool and intermediary expenses. Summit provides home office services and sales at a cost comparable to broker loads alone.

It’s a technical sale—we’re a technical company

Summit Re has 3 FSA-level actuaries and 2 CPAs that get involved in your coverage issues. We can tell you we cover LTAC days as standard inpatient days, not restricted step-down days—and be sure we pay the claims that way. Our sales cycle starts with understanding your risk, not just quoting on your current coverage.

Do you work with a retail broker today? You can still get a Summit Re quote. We compete with traditional brokers every day. The broker field is extremely competitive, but the number of reinsurers they have access to is not very large. And that list doesn’t include the largest— Swiss Re, only available through Summit Re.

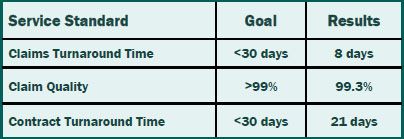

Putting Service in Service Standards

We set standards for ourselves so you can reap the benefits of timely and accurate service. Our claims and contracts staff prides themselves not only on meeting the service standards, but also consistently exceeding the standards.That means you can rely on timely and accurate service from Summit Re so you can concentrate on your business without worries about your reinsurance.

Clinical Notification Triggers

The clinical notice form should be used by the medical management staff to notify Summit Re of potential cases where Summit ReSources may be of assistance to you. Use the clinical notification triggers list as a guide. The list is not all inclusive, so feel free to submit a clinical notification on any case for which Summit Re may be of assistance to you.

Diagnosis

- High cost pharmacy, such as Flolan, Factor VII, Factor VIII, Cerezyme / ICD-9: 272.7, 286.0, 415.0, 416.0, 416.8

- Major burns with a potential for a prolonged hospitalization / ICD-9: 941.0, 942.0, 943.0, 945.0, 948.2-9

- ESRD/dialysis with monthly dialysis costs greater than $10,000 / ICD-9: V56.0, V56.8, V45.1

- Major injuries or multiple trauma with a potential for a prolonged hospitalization and/or acute rehabilitation admission

- Premature infants with one or more of the following:

- gestational age ≤ 24 weeks / ICD-9: 765.0

- severe congenital heart disease, e.g. hypoplastic left heat, Tetralogy of Fallot, etc. / ICD-9: 746.7, 746.01, 746.89, 745.2

- severe gastrointestinal anomalies, e.g. gastroschisis, omphalocele, necrotizing enterocolitis, short bowel syndrome, etc. / ICD-9: 756.79, 777.5, 777.8, 579.3, 756.79

- severe bronchopulmonary dysplasia requiring long term ventilator treatment / ICD-9: 770.7

Case Characteristics

- Out of network services with minimal or no negotiated discounts

- Billed charges that greatly exceed reasonable and customary for the services rendered – refer before the claim is paid

- Questionable charges, such as unbundling or experimental treatments

- Cases with the potential to exceed the reinsurance deductible

- Multiple inpatient stays

Submission Process for Clinical Notices

- Use the clinical notification triggers list as a guide for completion of clinical notifications submitted to Summit Re.

- It is recommended that the clinical notices be submitted from the medical management department as they are usually the department first notified of a request for services.

- Complete the Clinical Notification Form (all sections that apply to your case).

- Completed forms may be faxed to 260-469-3014, emailed via encrypted software to claims@summit-re.com, or mailed to Summit Reinsurance Services, 7030 Pointe Inverness Way, Suite 350*, Fort Wayne, IN 46804.

- In lieu of the clinical notification form, you may submit a report containing similar information.

*Address updated when this article was converted to this post in 2014.

Avoid Reinsurance Coverage Errors

This top ten list of coverage features that can limit a health plan's reinsurance recoveries is based on our experience in managed care reinsurance and reflected in InSight, our coverage analysis tool.

- Limited coverage for high-cost inpatient tertiary care referrals. Where are the high costs-per-day problems: in network or out-of-network?

- Artificial per diems, case rates or fee schedules that do not reflect actual plan costs.

- Reinsurance deductibles chosen at a level too low, producing too many reinsurance claims with the reinsurers margin built in.

- Inpatient per day coverage limits not mirroring plan underlying average daily costs for high cost claims.

- Purchasing reinsurance on budgetable claims such as professional services versus hospital inpatient-only coverage.

- Reinsuring chronic cases. Again, the reinsurer will build in its margin on a budgetable claim.

- Covering outpatient facility benefits which may have limited value for catastrophic reinsurance.

- Variable coinsurance and its potential for lowering coverage on high-cost out-of-network hospital confinements. Alternatively, coinsurance may vary by inpatient costs per day.

- Reinsurer definitions If the treaty has separate definitions for acute care, medically necessary or experimental treatments, the reinsurer may exclude certain claims that you have paid because of its ability to use its own definitions that may not match your health plans certificate of coverage.

- Alternate funding programs These complex programs are another way for a reinsurer to protect its downside risk without giving the plan real risk protection.

To avoid reinsurance coverage errors, contact us today to arrange for a demonstration of the coverage analysis tool. Current clients have a coverage analysis done as a routine part of our annual renewal process.