Swiss Re has received regulatory approval to merge Westport Insurance Corporation into Employers Reinsurance Corporation. The merger is an example of Swiss Re’s focus on smart capital management, delivering greater efficiency and reducing operating costs. Reinsurance agreements issued after January 1, 2008 will bear the Westport name. There will be no changes in coverage as a result of the merger. If you have any questions, please contact Summit Re at 260-469-3000.

Disclosure and insurability

Disclosure is the process of revealing information. To bind reinsurance coverage, you must reveal claimant data that may not have been available at the time of underwriting. This disclosure is important for identifying chronic situations that represent known risks and is necessary because of the inherent delay between underwriting the risks and binding the coverage. Disclosure is intended to be a quick review of the latest claim activity at the time that a binder for coverage is signed.

Why is disclosure important?

When preparing a quote, the reinsurer performs a careful analysis of claim costs and trends, including an analysis of the current year's activity. A critical assumption is the degree to which this data can be considered complete. Disclosure helps the reinsurer solidify the accuracy of this assumption.

The disclosure also identifies claimants that may be categorized as chronic and, therefore, highly predictable in both the usage and the cost of services. Depending upon the level of predictable costs, certain members may become uninsurable.

Further, the reinsurer may be able to immediately employ a managed care program to assist in the management of these new claims. This, of course, would potentially benefit both you and the reinsurer.

An accurate disclosure is important to you to protect against possible denial of a claim. The disclosure statement is part of the signed binder. Therefore, without full disclosure, the reinsurer has the right to exclude serious losses that were known by the plan, but not disclosed. This may be rare, but the reinsurer does this to protect against the situation where a party knowingly withholds serious losses.

What to disclose?

The disclosure statement (sample below) identifies the claimants that need to be disclosed: any member that is expected to have covered losses that will exceed 50% of the selected specific retention. Limiting this list to those representing a potential serious loss will expedite the process; however, you need to be careful to list all members that are known to you.

No matter how long or short your list, it is critical to provide the following data for each claimant:

- Diagnosis or diagnoses—allows the reinsurer to identify chronic or ongoing care which is highly predictable in nature.

- Prognosis—helps identify a near term resolution versus an ongoing situation and helps identify future costs. An estimate of future costs should accompany a prognosis.

- Charges/claim amount—identifies the magnitude of the claim.

- Current status and future treatments—supports the information provided in the prognosis.

When these items are provided in a concise but thorough manner for each disclosed claimant, the process can usually be completed very quickly with little, if any, additional discussions of clinical details.

What are the possible outcomes?

Most likely the disclosure will reveal a normal level of catastrophic claim activity of an acute nature, which allows the reinsurer to confirm the terms as originally priced.

Another scenario is that a chronic claim is identified to have a high probability of continuing into the coverage period in question, and a separate deductible may be assigned to that claim if it is likely to exceed the retention. This has now become a known claim to both you and the reinsurer and, therefore, uninsurable. A basic premise of insurance is that known events with predictable costs are not insurable.

A third scenario is that the disclosed claim information is dramatically different from the claim information presented during the quotation process, and the reinsurer is forced either to materially modify its quoted rates or terms or to completely withdraw their quotation. This rarely occurs.

Disclosure Statement by Reinsured

(Used by Summit Re and ERC/Swiss Re)

You agree that any serious losses known by you as of the date you sign this Offer will be excluded from coverage unless previously disclosed to and accepted by ERC. Please enclose with this Offer any serious claim information that has come to your attention so that we may re-evaluate our underwriting. A "serious claim" is defined as any loss known by you for which:

- Charges incurred have exceeded 50% of the Specific Retention selected; or

- Charges are expected to exceed the Specific Retention selected due to the nature of the illness or injury; or

- Any Member remains hospitalized or disabled and is expected to exceed 50% of the Specific Retention.

Information submitted for each serious claim should include the diagnosis or diagnoses, prognosis, charges/claim amount, current status, and future treatments.

What are you, Summit Re?

“What is Summit Re, a broker?” ask some individuals in the industry who haven’t worked with us before. Technically, we are regulated as a Reinsurance Intermediary Broker, which is very different from the retail broker you may have dealt with before. We place reinsurance for health plans, but only for ERC/Swiss Re. And we do so much more: we’re responsible for underwriting each risk, developing and maintaining underwriting and pricing manuals, drafting contracts, processing claims and premium payments, servicing accounts, and maintaining managed care vendor relationships.

The health plan reinsurance marketplace is divided roughly in half between coverages that are delivered directly, which is the way we do business, and those placed through brokers. Which is better? Competition keeps all of us on our toes, but here are reasons we prefer direct distribution.

Deal directly with the decision-makers

Your Summit account team doesn’t just sell a coverage, it prepares and delivers the contract language, pays claims under that contract, and works with your medical management team to reduce current and future medical expenses.

Short distribution chain, low expenses

ERC/Swiss Re retains the risks it writes, so there are no back-end pool and intermediary expenses. Summit provides home office services and sales at a cost comparable to broker loads alone.

It’s a technical sale—we’re a technical company

Summit Re has 3 FSA-level actuaries and 2 CPAs that get involved in your coverage issues. We can tell you we cover LTAC days as standard inpatient days, not restricted step-down days—and be sure we pay the claims that way. Our sales cycle starts with understanding your risk, not just quoting on your current coverage.

Do you work with a retail broker today? You can still get a Summit Re quote. We compete with traditional brokers every day. The broker field is extremely competitive, but the number of reinsurers they have access to is not very large. And that list doesn’t include the largest— Swiss Re, only available through Summit Re.

Swiss Re Purchase of ERC

On June 10, 2006, Employers Reinsurance Corporation (ERC) was acquired by Swiss Re. Both Summit Re and ERC are excited about this business transaction, as it will increase our ability to provide you with the best financial security, expertise and service in the reinsurance industry. The transaction includes all of the Commercial Insurance operations of Employers Reinsurance Corporation. Swiss Re specifically sought to include the HMO reinsurance and employer stop loss product lines in this transaction and has plans to grow the Commercial Insurance operations.

Effective with the closing, the senior management of the Commercial Insurance division of ERC will remain in place, including Robin Sterneck, President, and Jeff Argotsinger, Vice President and medical excess product manager.

ERC, as a part of Swiss Re, will provide our customers with even more customized solutions. As a company focused solely on insurance and reinsurance risk worldwide, Swiss Re recognizes the value of building and growing customer relationships for the long term. Swiss Re is now the world’s largest reinsurance company in both property/casualty and life/health business.

As part of the transaction, General Electric, the former parent of ERC, has acquired 9% of Swiss Re shares and will have a board seat. GE is essentially taking a smaller share in a larger operation.

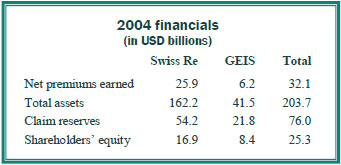

With this acquisition of ERC, Swiss Re took a strong balance sheet and made it even stronger. ERC is currently rated A by AM Best, and Swiss Re is A+. Below is a summary of the financials of the combined operation (2005 results were not yet available).

Summit Re and ERC have a long term agreement to underwrite catastrophic medical excess reinsurance together. We look forward to the opportunity to provide HMOs and other managed care plans with reinsurance through our exclusive relationship with ERC. Swiss Re management has re-approved our marketing plan, pricing / underwriting manuals and guidelines.

If you have any questions, please feel free to contact your Summit Re Regional Vice President or call Brian Fehlhaber at 260-469-3004.