Medicare reimbursement is one of the top issues that our clients face, so we’ve identified a unique way to make your Medicare revenue recovery much less of a headache.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Morbidity-based payments

The Medicare Advantage program operates under a diagnosis-based risk adjustment system that pays higher monthly capitation rates for enrollees with higher morbidity levels. Diagnosis codes extracted from medical claims are submitted to Centers for Medicare and Medicaid Services (CMS). CMS uses these diagnoses to assign enrollees to disease categories. The problem is that medical claims often do not reflect the enrollees’ true morbidity:

- Only a fraction of the diseases and conditions documented in the medical record ever make it to the claim form or record submitted to the health plan.

- New enrollees often have inadequate claims information.

- Inadequate diagnosis coding is common because diagnosis codes rarely factor into the claims adjudication process.

Every disease not submitted to CMS that is included in the CMSHCC (Hierarchical Condition Categories) model represents lost revenue. This lost revenue is most acute for patients with comorbidities, who are likely to require a disproportionate share of your resources.

Lost Opportunity

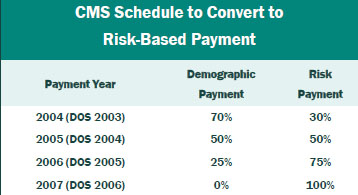

If you have not reviewed medical records for additional HCCs in the past two years, you may have given up significant revenue. The portion of the capitation payment attributable to medical diagnosis is being phased in by Medicare Revenue Recovery ReSource CMS through 2007, at which time 100% of the premium payment will be risk based. The table gives the transition schedule.

Results

Working closely with your staff, Beam clinical staff assesses data and medical charts to maximize recovery of lost premium. The results can be substantial. Based on its experience, Beam Partners estimates recoveries of about $3 million for every 10,000 members in the Medicare plan. Therefore, for plans with 25,000 members, approximately $7.5 million of additional recoveries is typical.

Contact: Your Summit Re account manager or Brian Fehlhaber, VP, Sales and Marketing at 260-469-3004 or bfehlhaber@summit-re.com.