The Assist Group specializes in solutions for catastrophic claims management and high-risk premature infants. Current products include CareAssist, a unique, physician-driven neonatal care management program, and ClinAssist, a powerful forensic audit and claims resolution service. The Assist Group has a proven track record for delivering financial value to clients. For more information about these products and services, please visit the company's website, www.assistgroup.com, or contact Debbie Stubbs, RN, MS, CCM at Summit Re, 260-407-3979.

CareAssist Success Story: 32 % Reduction in Length of Stay and $163,693 Savings

This twin boy was born at 25 weeks, weighing one pound, eight ounces. His mother used multiple illicit drugs throughout her pregnancy and on the day of delivery. He was on mechanical ventilation and in critical condition when referred to CareAssist on day of life (DOL) 17. This infant was not expected to survive due to his prenatal history, the circumstances of his birth, and extreme prematurity. The CareAssist neonatologist recommended an ethics committee consultation to discuss quality of life issues when it became evident on DOL 30 that he would survive. By then, this infant had the severest form of intraventricular hemorrhage, along with hydrocephaly and porencephaly. He also had severe chronic lung disease (CLD) and remained on mechanical ventilation well past his first month of life. His long-term prognosis was poor.

His final discharge disposition further complicated his clinical status as his mother continued to struggle with polydrug abuse and was considered unsuitable to care for him after discharge. CareAssist consistently recommended early discharge planning to allow a foster family to be trained to care for this infant upon discharge. This timely intervention allowed this baby boy to be discharged appropriately and safely.

Multiple oxygen weaning recommendations were made by the CareAssist neonatologist. This infant was eventually weaned to nasal cannula oxygen on DOL 59 and was discharged on low flow nasal cannula oxygen. This infant’s nutritional status was complicated by his CLD and tendency to tire during feedings secondary to his compromised pulmonary status. The steroids used to help wean him from supplemental oxygen also compromised his ability to gain weight. The CareAssist neonatologist emphasized to the treating team the importance of using high calorie formula and advised early developmental interventions through the use of non-nutritive sucking and OT/PT involvement in nipple training. As a result of these interventions, the infant was nippling all of his feedings at a corrected age of just 35 weeks.

The weekly care oversight by CareAssist for nearly three months ensured consistency in the implementation of this infant’s treatment plan. Due to CareAssist’s oversight, this infant was discharged safely to foster care 39 days earlier than originally anticipated. This resulted in a 32% savings of $163,693.

ClinAssist Success Story: $321,757 Savings

A 110-day confinement at a children’s hospital resulted in total billed charges of $1,287,027. ClinAssist reviewed approximately 10,600 line items of detailed charges. Utilizing the clinical expertise of ClinAssist’s neonatologists and nurses, ClinAssist performed a forensic review of the charges and identified the following exceptions:

- Room and board charges billed at incorrect levels of acuity

- Experimental pharmaceutical therapies

- Supplies and services incorrectly unbundled from the room and board charges

ClinAssist successfully achieved a $321,757 reduction in billed charges after the audit exceptions were presented to the facility. The account balance was adjusted to reflect the facility’s written agreement that the exceptions identified by ClinAssist were not payable charges.

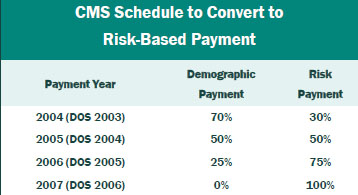

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.