Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With more than 55,000 employees, it provides a wide range of general insurance and life insurance products and services. Zurich’s customers include individuals, small businesses, and mid-sized and large companies, including multinational corporations, in more than 170 countries. The Group is headquartered in Zurich, Switzerland, where it was founded in 1872. The holding company, Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX. Further information about Zurich is available at www.zurich.com. In North America, Zurich is a leading commercial property-casualty insurance provider serving the global corporate, large corporate, middle market, specialties and programs sectors through the individual member companies of Zurich in North America, including Zurich American Insurance Company. Life insurance and disability coverage issued in the United States in all states except New York is issued by Zurich American Life Insurance Company, an Illinois domestic life insurance company. In New York, life insurance and disability coverage is issued by Zurich American Life Insurance Company of New York, a New York domestic life insurance company. For more information about the products and services it offers and people Zurich employs around the world go to www.zurichna.com. 2012 marked Zurich's 100 year anniversary of insuring America and the success of its customers, shareholders and employees.

Zurich Financial Strength

Financial strength ratings (as of September 30, 2014): A.M. Best > A+/Stable

Standard & Poor's > AA-/Stable

Recognition and awards:

Zurich named “Best Insurance Company” (Captive LIVE USA Conference, October 2014)

2014 Innovation Award: “What if?” Zurich Risk Grading™ Application (Business Insurance, March 2014)

Zurich winner of the AGC Community Award (Associated General Contractors of America, Annual Conference, March 2014)

2014 Innovation Showcase: “Zurich Risk Room” and “My Zurich Portal” (Best’s Review magazine, January 2014)

Zurich “Best Political Risk Insurer,” “Best Global Supply Chain/Trade Disruption Insurer,” “Best Property Insurer,” “Best D&O Insurer,” “Best Employment Practices Liability Insurer,” “Best Crime/Fidelity Insurer” and “Best General Liability Insurer” (Global Finance Magazine, October 2013)

Zurich’s Trade Credit and Political Risk group named “Best Private Insurer in Trade,” “Best Trade Insurer in North America,” “Best Trade Insurer in Asia Pacific” and “Best Trade Insurer in Latin America” (Trade Finance, June 2013)

2013 Innovation Award: Zurich Risk Room Mobile Application (Business Insurance, March 2013)

2013 “Innovation in Fronting” Award: UK Captive Services Awards (Captive Review, February 2013)

Zurich named “Best Fronter of the Year” (Captive LIVE USA Conference, September 2012)

Zurich’s Trade Credit and Political Risk group named “Best Private Insurer,” “Best Trade Insurer in Asia Pacific” and “Best Trade Insurer in North America” (Trade Finance, August 2012)

Zurich named “2011 Insurer of the Year” (Daimler Financial Services AG, August 2012)

Innovation Award for Zurich Multinational Insurance Application (Zurich MIA) (Business Insurance, March 2012)

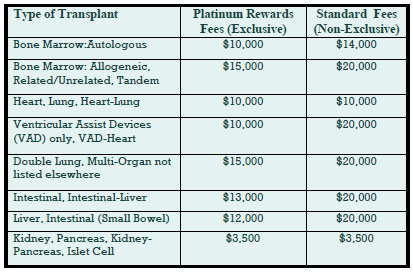

Deep Discounts on Transplant Program Fees

Deeply discounted transplant access fees are available through our new Platinum Rewards program, an enhanced OptumHealth Care Solutions (formerly United Resource Networks) program. This program is available only to Summit Re’s clients. Under our previous program, you received a 5% discount on network access fees, an additional 5% discount if you agreed only to use OptumHealth’s networks, and up to 10% based on Summit Re’s total volume of business with OptumHealth. The third discount was calculated retrospectively.

These three potential discounts are now bundled into one substantial discount. The program is easier to use and easier to understand. You will be able to realize the total savings we've negotiated “up front” through reduced access fees.

The savings from the Platinum Rewards program can be significant, as shown in the chart. Based on our historical case mix, the Platinum Rewards program represents an effective 27% discount off standard OptumHealth fees.

To be eligible for Platinum Rewards, you must agree only to use the OptumHealth networks for your transplants, although you can still “carve out” facilities with which you have your own contracts.

The new program is effective on January 1, 2008. You will need to execute a new Payer Access Agreement, selecting either the fees for the Platinum Rewards program or the standard access fees.

Platinum Rewards Frequently Asked Questions

Which of the OptumHealth programs will be subject to the reduced fees?

The reduced fees apply to the Transplant Resource Services’ Centers of Excellence program and the Transplant Access Program for business that is reinsured through Summit Re. All other OptumHealth program fees remain unchanged.

Do the reduced fees apply to both adult and pediatric transplants?

Yes, the reduced fees apply to adult and pediatric transplants.

How will the Platinum Rewards program affect the OptumHealth transplant facility contracts and services?

The new program has the same facility contracts and services contained under the current OptumHealth programs.

Will I be able to “carve out” a specific facility from the OptumHealth contract and use my own contract at that OptumHealth facility?

You will still have the capability of carving out a facility or facilities from the OptumHealth agreement. Those facilities should be listed on Exhibit C of the Payer Access Agreement.

What happens if I want to use another transplant network in addition to OptumHealth?

You may use another network in addition to OptumHealth. However, if you do so, you will not be eligible for the reduced fees available through the Platinum Rewards program. You will pay OptumHealth’s standard access fees.

What do I need to do to initiate the new program?

If you are currently accessing OptumHealth through Summit Re, you will need to sign a new Payer Access Agreement. New Payer Access Agreements will be mailed to Summit Re clients. Be sure to indicate if you intend to use the OptumHealth network only or if you will use another network in addition to OptumHealth’s network.

Will I still receive this year’s discount based on Summit Re’s total volume of business with OptumHealth?

You will still be eligible for the discount for 2007 based on Summit Re’s total volume of business with OptumHealth, provided you are a Summit Re client at the time the refund is paid. OptumHealth has committed to paying this refund within 60 days after the end of the calendar year.

ERC / Westport Merger

Swiss Re has received regulatory approval to merge Westport Insurance Corporation into Employers Reinsurance Corporation. The merger is an example of Swiss Re’s focus on smart capital management, delivering greater efficiency and reducing operating costs. Reinsurance agreements issued after January 1, 2008 will bear the Westport name. There will be no changes in coverage as a result of the merger. If you have any questions, please contact Summit Re at 260-469-3000.

After the Claims are Paid

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. This case study addresses one of the latest developments in managed care—post-payment administration and claim recovery. Imagine the impact on your bottom line if you recovered 2 to 3 percent of claims, after all current internal processes were completed.

This service is available through Summit Re’s arrangement with Health Decisions, Inc., one of the most comprehensive and sophisticated post-payment administrators in the country. Independent benchmarking analyses have confirmed that its approach sets new standards for the use of data produced by claim payment, enrollment, and related systems. Through its services, you have access to postpayment support equivalent to that available to the largest payers— without development costs or lead time.

Potential recovery areas

The focus for recoveries occurs in the following areas:

- Other liable parties not correctly reported by enrollees for benefit coordination

- Medicare-as-primary payer (ESRD, retirees, disabled) to offset any Medicare-as secondary-payer demands

- Enrollment discrepancies, such as ineligible and terminated members, family status changes, etc.

- Provider billing errors, such as inappropriate service codes, unbundling, duplicate payments, discount avoidance, fee inflation, double billing, etc.

- “Not a covered benefit” enforcement at the procedure code level

- Judicial judgments, such as divorces, workers compensation, and subrogation

Services available

Existing data are combined with new data and converted to Microsoft® compatible files. This new data set has many applications, including supporting internal client management, maximizing claim recovery returns and processing efficiency, and supporting new client service offerings.

Claim Recovery Service

Identifies claims that should have been paid by others and pursues collection from other payers, such as Medicare or insurers, and providers.

Enrollment Support Service

Handles all the details of special (non-routine) employee/enrollee communications to compile, compare and reconcile internal and external data files across multiple payers.

Recovery Software

Use of Health Decisions, Inc.’s proprietary software on internal network systems.

Data Support Services

A full range of technical support permits translation of any documented file structure into Microsoft® compatible files for HIPAA compliant data analysis, reporting and warehousing.

Flexible payment arrangements

Health Decisions, Inc. can be compensated on a contingency basis, keeping 33% of recovered claim amounts. Health Decisions, Inc. is also willing to enter into a multiyear, fixed-fee software lease covering its Paperless Claim Recovery software suite and all related support services.

Client results

Client “A” used post-payment findings to pursue claim recovery and returned $15 per member per year to its bottom line.

Client “B” used post-payment findings as a continuous-quality improvement management tool to monitor internal performance improvements.

Client “C” used post-payment findings to pinpoint “problem” providers and to support provider contracting negotiations.

Health Decisions, Inc.

Health Decisions, Inc. is an established, reputable and successful post-payment administration and claim recovery vendor. In one yearalone, they processed almost two billion dollars of paid claims. In the area of claim recovery, nobody addresses more recovery areas (40+ review areas), offers a lower recovery threshold (all claims over $10) or recovers a greater amount of money per client (2-3 percent of claims).

Managing Capital Through Reinsurance

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. Summit Re works with London Life Reinsurance Company to provide reinsurance transactions that achieve risk-based capital (RBC) relief for qualified prospects.

Benefits

There are several potential benefits resulting from such reinsurance transactions:

- Proper capital and surplus management can improve debt and claim paying ratings.

- Reducing required capital requirements increases business line return on equity.

- Dividend capacity can be improved for entities with holding company structures.

- Individual plan or product line loss ratios can be stabilized for external understanding.

- New business can be more competitively priced.

These programs can be developed for single-site organizations as well as regional and national chains. They can be designed easily for entities that have affiliated domestic or offshore companies. However, they also can work with a nonowned, protected-cell approach. All programs are structured to meet applicable risk-transfer regulations. Solutions are customized to meet each company’s specific objectives and requirements.

Case Study

Here’s an example of one of our clients' capital management programs developed through its relationship with Summit Re:

ABC Health Plan is a regional health plan. Its business is ceded to London Life via a 100% quota share above the HMO’s retention level. London Life, in turn, retrocedes the business on the same terms to a captive affiliate of ABC Health Plan. The transaction is designed to meet all regulatory requirements for full risk transfer and credit for reinsurance. In addition, the transaction has been disclosed to the insurance department of the state of domicile of ABC Health Plan.

Regulators often prefer or require independent professional reinsurers as the conduits for such transactions to minimize the potential for improper related-party transactions. The state insurance department in this case relied on the financial strength of the licensed and authorized professional reinsurer to fulfill its reinsurance obligations to ABC Health Plan. ABC Health Plan’s holding company is free to establish appropriate GAAP reserves and equity consistent with sound actuarial principles and subject to the reserve and capital requirements of the domicile of the captive.

Health RBC Relief Structure in Brief

The typical structure is modified coinsurance or coinsurance with funds withheld to minimize asset transfer. The only cash flow is your payment of the risk fee.

Reserves are held in asset trust by the reinsured.

There is parental guaranty on the retrocession treaty, if retrocession is used.

All profits, net of risk fee, are returned to you through an experience refund.

There is monthly accounting.

The health risk-based capital relief structure has the following risk reducing features:

- Expense allowances set about equal to “marginal” expenses.

- Losses to reinsurer are carried in loss carryforward and repaid through future profits. Ceding company must repay any losses if it terminates agreement early.

- Loss to reinsurer usually limited by stop loss (typically 10% of premium).

- Reinsurer can terminate agreement with minimum notice (usually 3 months).

- Allows ceding company to release RBC requirement on business ceded.

- Designed to pass required level of risk to reinsurer to meet risk transfer regulations.

- Minimizes the cost of reinsurance to the ceding company (1% of premium or less).

Is Your Liability Coverage Adequate?

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. “I confess through my own fault, in my thoughts and in my words, in what I have done, and what I have failed to do.” Although these words are part of the Confiteor, a Catholic prayer in which persons saying the prayer confess their sins, it could be the start of a discussion of errors and omissions (E&O) and directors and officers (D&O) coverages.

Errors and Omissions

E&O insurance policies cover things a company does, things a company does not do, or things that simply do not turn out as a customer or other third party expected.

E&O for a managed care plan covers you for the vicarious liability assumed for the business processes that are part of a health care delivery system, such as credentialing, UR, and claims. An IPA can be sued for malpractice, since patients, through the IPA’s advertising, may assume that their physicians are under the IPA’s control and the IPA is liable for their actions. Another emerging area is security and privacy liability, including health care history and personal information.

Directors and Officers

D&O coverage is designed to protect the officers and directors of a company for liability associated with business decisions and certain employment practices. Liability can arise from decisions regarding merger and acquisition disputes, failure to perform fiduciary duties (such as signing contracts that harm the value of the company’s stock), actions that violate anti-trust regulations, and business interference, to give a few examples. Liability can also arise from employment practices, such as discrimination, harassment, or wrongful termination.

D&O insurance policies provide protection for a company’s directors and officers whose personal financial assets can be put at risk in the event of a lawsuit regarding their decisions. It’s difficult enough to lose company financial resources because of inadequate or inappropriate insurance coverage; imagine how it would be if your own personal assets were at risk as well.

Coverage characteristics

There are no standard E&O and D&O policies. Each insurer drafts its own policy forms and some fail to provide coverage in key areas for health plan exposures. A recent study showed that over 50% of directors and officers requested changes in their insurance coverage when they learned what was NOT covered under their current program.

Premiums are a function of the case size, liability and retention and can range from $10,000 to $100,000. Coverage, not price, is key because potential liabilities are so large.

Free coverage analysis

A free analysis of your current coverage is available to see if it’s possible to access better coverage at better rates. To give health plans access to better E&O and D&O policies, Summit Re has an arrangement with a national firm that specializes in property and casualty insurance products specifically designed for the health care industry.

We’ve offered this analysis of E&O and D&O coverage to several clients and they have appreciated the additional options presented as a result. We can do the same for you. To get started, please send us a copy of your current E&O and D&O policies. Typical insurer markets that provide these types of coverage include Lexington, Darwin Professional, Lloyd's of London and OneBeacon. Our program manager has access to all of these markets. We are happy to disclose all commissions and service fee arrangements.

Family Planning Rider

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. What do you do when your customers repeatedly request coverage which you are prevented from offering? This client turned to Summit Re for the solution.

The conflict

A large, regional HMO client had received repeated requests from its insured employer groups to provide coverage for family planning services. Because the health plan was owned by a Catholic hospital system, it was not able to accommodate these requests through its traditional HMO products. The health plan contacted Summit Re for assistance in solving this ongoing problem.

The resolution

Summit Re has a relationship with Advisors, LLC, a Michigan-based company that provides specialized group insurance consulting, product management, provider contracting, and network development services. Summit Re knew that Advisors, LLC had an arrangement with Unified Life Insurance Company (licensed in 45 states and the District of Columbia and rated B++ by A.M. Best) to provide independent, supplemental group insurance policies to selected Catholic-sponsored HMOs. Unified Life's Family Planning product and the Unified Life/HMO business arrangement are specifically designed to provide HMOs with an effective means to meet client demands for family planning services and still remain compliant with the ethical directives of the Catholic church and state insurance laws.

Flexible components

The flexible package of covered services operates with HMO, POS, or PPO plan designs. These services may be covered in any combination to meet individual employer group needs:

- Artificial insemination services

- Tubal ligations

- Vasectomies

- Pregnancy terminations

- Oral contraceptives

- Contraceptive devices

Direct administration

The Unified Life Family Planning product is issued directly to each employer group. As a consequence, the I.D. card of the Catholic sponsored HMO is not used at the pharmacy, claims for drugs and services are not the HMO's financial responsibility, provider services are provided through independent Unified Life provider contracts, and the HMO's filed certificate of coverage and rates can specifically exclude family planning services. Under the Unified Life approach, the HMO provides only limited cooperation by assisting the client with Unified Life set-up arrangements, providing monthly eligibility files and collecting premium. Often, the last service can be facilitated by a bank-trust arrangement.

All appropriate policies, benefit schedules, rates and forms are filed for each HMO arrangement with the state authorities by Unified Life. Each covered group is issued a Unified Life policy and all eligible members are given a benefit schedule and plan administrative information. Unified Life contracts independently of the HMO with a prescription benefit manager for contraceptive prescription services and medical providers for all other plan services.

Simple process

The Family Planning product operates very simply with no special actions required of employer groups and minimal member involvement. A brief summary of the product's operation follows:

- At the point of group installation, the HMO transmits the eligible membership data to Unified Life.

- Unified Life provides benefit notices to all covered members, which are delivered along with the HMO's standard member material. The benefit notice informs members of the benefit services available, the list of participating providers and Unified Life's toll-free telephone number to be used for all Family Planning benefit inquiries.

- Covered members are encouraged to use Unified Life's network of participating providers for the delivery of covered services. If members use other providers, Unified Life will pay the provider up to the level of Unified Life's fee schedule. No referral from the primary care physician or plan service authorization is needed by the member.

- Covered members using contraceptives for birth control purposes are given a special prescription drug ID card which operates like a standard ID card at the pharmacy, but only for contraceptives.

- Medical service providers directly bill Unified Life and are typically paid within two weeks of receipt.

- Unified Life delivers a group insurance policy to each employer group.

- Unified Life receives monthly electronic eligibility updates from the HMO.

- As a service to the employer group, the HMO collects a combined (HMO and Unified Life) premium from all covered groups and wire transfers the Family Planning product premium to Unified Life monthly. Some clients prefer to use their banks for premium receipt and dispersal functions.

Epilogue

Summit Re facilitated a meeting between the health plan and Advisors, LLC. The health plan and Advisors LLC worked out a plan that was specifically tailored for its marketplace. The program was implemented with ease and has been operating successfully.

Secure Extranet

It makes good business sense to save money and time by reducing the amount of paper you use and by reducing costs associated with mailing and faxing. It is also importantto safeguard Private Health Information according to HIPAA privacy rules.

We have addressed those issues by introducing our secure extranet. You are now able to send us claims, underwriting data, and any other confidential information via the secure extranet. We are also now sending our clients quarterly premium and claims reports this way. The extranet accepts any type of document, including .zip and .pdf files.

To use the secure extranet, go to our website, www.summit-re.com, and select “Extranet-Login” from the top right side of the home page. If you have a username and password, you can send files to us and receive files from us through this web portal.

If you do not have a username and password, contact Kris Lahey at klahey@summit-re.com or call her at 260-469-3017. She will set you up with a username and password, instruct you on its use, and answer any questions you may have.

Cover transplants from first dollar

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. A typical HMO excess coverage provides risk protection for all catastrophic events—traumas, transplants, neonatal cases, and other complex medical claims. Some plans, however, prefer to "carve out" certain risks from their medical excess coverage and have specific coverage for the given risk on a first dollar basis. Organ and bone marrow transplant carve-out coverage is such an example.

The need

ABC Health Plan is a public hospital board authorized by statute to operate a hospital service plan in its state. Because the plan desired predictability and the plan's hospital owner is not a major tertiary provider for organ transplants (excluding kidneys), the plan was interested in having organ transplants carved out from its risk.

The solution

Summit Re provided ABC Health Plan an organ transplant carve-out through United HealthCare Insurance Company, part of OptumHealth Care Solutions’ (formerly United Resource Networks) family of transplant programs. Summit Re still provides the medical excess coverage to ABC Health Plan in excess of its $90,000 deductible with an appropriate credit for the organ transplant carve-out now reinsured by United.

The result

ABC Health Plan has renewed the program for several years with predictable renewals and has access to excellent organ transplant case management and provider contracts. A typical premium for this type of coverage is $2.00-$4.00 per member per month, depending on the parameters of the risk.

Coverage details

Covered organ transplant procedures include liver, kidney, heart, lung, heart/lung, double lung, pancreas or simultaneous pancreas/kidney. Digestive transplants are covered only when performed by a facility that participates in the transplant network. Coinsurance is higher for services provided by non-network facilities.

Transplant services include all medically necessary services resulting from and/or directly related to an organ or bone marrow transplant procedure, including:

- Services provided by the transplant facility

- Hospital or skilled nursing facility services

- Physician services

- Nursing services

- Outpatient treatment and follow-up

- Speech, physical and occupational therapy

- Anesthesia and anesthesia services

- Radiology

- Laboratory services

- Oxygen

- Durable medical equipment

- Blood and blood products

- Dressings

- Harvesting and acquisition expense

- Transportation, lodging and meals for transplant candidate and one companion

Typical services NOT covered include:

- Services received before or after the benefit period, other than services for bone marrow harvesting, transplant evaluation, living donor organ procurement, air ambulance or transportation, lodging or meals related to the covered transplant procedure

- Organ or tissue transplants performed prior to the member’s effective date

- Services not related to the covered transplant procedure

- Services unrelated to the diagnosis or treatment of the transplant procedure

- Drugs that are investigational or have not been approved for general sale by the FDA

- Items which are not medically necessary