Brokers, managing underwriters, and reinsurers are subject to a wide variety of licensing and compliance requirements. Summit Re believes in playing by the rules and a level playing field. To that end, we have obtained a wide variety of licenses to meet specific state requirements (e.g., general agency, reinsurance intermediary broker or manager, managing underwriter, general business corporation). Can you imagine selling against an unlicensed HMO? We are aware that some of our competitors have taken shortcuts in these regards on the employer stop-loss and/or HMO reinsurance business. You might ask the sales representatives of other carriers or managing underwriters if they have all the required licenses. You should have them explain how they are licensed and show you a copy. Its only good business to deal with companies which are properly compliant, especially in today's environment of close scrutiny.

New Staff Expands Summit Re’s Expertise

Summit Re and GE Insurance Solutions announced the hiring of three new managed healthcare reinsurance personnel in 2004. We are committed to hiring the personnel needed to expand our presence in the managed healthcare reinsurance marketplace and provide our customers unmatched service. We remain dedicated to this market and customers we serve. The addition of the following talents enhances an already strong team. John Broyles joined Summit Re on January 19. John formerly worked for Risk Based Solutions as a principal and founder. He is excited to be part of the Summit Re and ERC managed care reinsurance growth strategy. John will sell to and service health plans in selected regions as Regional Vice President, Sales.

Larry Jackson joined Summit Re on July 19. Larry is a former Lincoln Re employee with 18 years of experience in the healthcare actuarial arena, specifically employer stop loss and health plan reinsurance. He will underwrite managed healthcare and employer stop loss accounts and assist in the maintenance of pricing programs and managed care network analysis.

Deborah Stubbs joined Summit Re on September 7 as a managed care specialist. She is responsible for providing consultative case management services to our clients, assisting our underwriters in the assessment of potential catastrophic claims and leading the managed care vendor selection process. Debbie also meets with clients and prospects to explain our value-added managed care services. Debbie was most recently the Manager - Training and Education for the utilization management department of Kaiser Permanente of the Mid-Atlantic States.

Buy Direct or Use a Middleman?

Are you contacted relentlessly by reinsurance brokers? We believe in marketing directly to our customers, rather than through a middleman. The advantages of direct marketing include:

- Direct contact with you enables us to do our own risk analysis to best match excess coverage to a plans needs and objectives. This direct interaction is particularly important due to complex product structures and your evolving needs.

- Field underwriting gives us a thorough understanding of the risk that you are assuming, rather than relying on a middleman for critical information.

- Understanding your unique strategies and having direct contact with your management allows us to match other products and services to your plans needs.

- Expense management is needed for long-term survival in a competitive managed care market. A typical broker commission adds 10 percent to premium costs.

Summit Re/GE Insurance Solutions is one of four major providers of HMO excess loss coverage, defined as carriers with over 10% market share each. Two of the four top reinsurers market directly. This means that if you use a broker and don't also access the direct markets like Summit Re independently of your broker, you will miss quotes from half of the major reinsurers. Certain brokers may even be unable to access some broker markets because they have no relationship with the carrier. This reduces the broker's reach even further.

If you do use a broker, nothing stops you from accessing the expertise of Summit Re, as well. If you give us a chance to help you, you won't be disappointed.

GE Insurance Solutions: Rebranding GE’s Employers Reinsurance

In September General Electric (NYSE: GE) announced it will unify the branding of its reinsurance and commercial insurance products and services as GE Insurance Solutions. "The name change is significant, yet it's the first step toward building a powerful brand, said Ron Pressman," Chairman, President and CEO. "Our brand is our promise to our customers that they will get world-leading risk expertise from dedicated people who build strong relationships by delivering unsurpassed customer service."

Pressman continued: "The foundations of our brand are in place. We've retooled the organization by our strong customer relationships and rededicating ourselves to delivering the kinds of solutions our customers need to succeed in their markets. With more than $50 billion in combined assets and $7 billion in statutory capital, this business has never been stronger financially or strategically."

The new brand name replaces Employers GE Re, Frankona Re, Westport Insurance and nearly a dozen other go-to-market names. However, insurance and reinsurance risks will continue to be underwritten by the existing legal entities, whose legal names will not change. GE Global Insurance Holdings is changing its name to GE Insurance Solutions Corporation.

The announcement of the new GE Insurance Solutions brand is part of an overall rebranding at GE, which is dramatically reducing its market-facing entities and names. GE Insurance Solutions is a group of companies that protects people, property and reputations. With more than $50 billion in combined assets, GE Insurance Solutions is one of the leading providers of commercial insurance, reinsurance and risk management services.

A. M. Best Affirms ERC’s Excellent Rating

The following comments are from a GE Insurance Solutions press release regarding a rating review by A.M. Best. The affirmation of Employers Re's financial strength rating by A.M. Best reflects its excellent risk-adjusted capitalization, improving operating performance and its dominant market presence and distribution capabilities. With two years of improving underwriting results bolstered by asset sales and other capital management improvements, as well as significant third-party aggregate stop loss protection, Employers Re has maintained capital in line with an A (Excellent) rating and has exhibited prospective long-term earnings capability stemming from its well diversified business platform. In addition, over the past two years the company has executed underwriting actions, implemented tighter underwriting controls and has maintained its prominence in the worldwide reinsurance markets through its international distribution capabilities.

Healthcare.com: Fast and Accurate Underwriting

GE Insurance Solutions has developed a web-based rating and underwriting program that allows interactive communication between Summit Re and GE Insurance Solutions. Healthcare.com uses a single entry source that helps eliminate errors and yields more efficient underwriting capabilities. Customers benefit from quicker turn-around times on their quotes, as well as more accurate proposals and contracts. *Note: This article was current in 2004, but the URL Healthcare.com now houses another site.

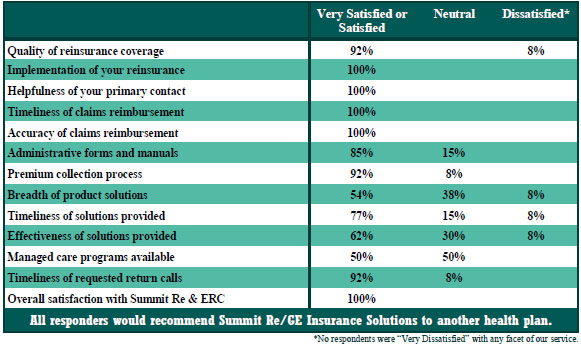

2004 Customer Service Survey: All responders recommend Summit Re

Customer service is more than a buzzword to us; it is an integral part of who we are. Our annual customer service survey allows us to do our job better and ensures we're best meeting your needs. It also identifies any problem areas early so we can correct them! Another sign of our service commitment is the establishment of service standards for each client interaction such as underwriting, premium and claim administration and installation of managed care programs. We then report to every client how we've performed for them on these standards.

Overall, claims are being paid within 9 days and contracts are being issued within 29 days upon receipt of all required information. If we can take care of meeting your needs, we believe the needs of the rest of our stakeholders (reinsurer, employees and owners of Summit Re) will be met as well.

Summit ReSources: Complement Your Managed Care Programs

Catastrophic managed care programs need to complement rather than replace your programs. Summit Re and GE Insurance Solutions are dedicated to providing you protection from catastrophic claims. Together, we designed Summit ReSources, a program of managed care services whose goal is to bring value and service support in your management of catastrophic risk. In most situations, the managed care expenses of vendors are treated as an eligible claim expense by ERC. Our website (www.summit-re.com) has a complete listing of the programs which are available.

Add Lives Under Management with Employer Stop-loss

Many employers turn to HMOs and other strongly managed care programs to control healthcare costs, while others look to the cost-control aspects of self-funding. HMOs that can offer administrative services to self-funded employers bring the best of both worlds. To take advantage of this opportunity and to increase your lives under management, you need actuaries and underwriters equipped to understand this combination of funding and managed care savings. Summit Re's level of managed care experience sets us apart from others in the self-funded marketplace that experiment in the managed care world.

Key strengths that we bring to you include our ability to analyze managed care networks and develop customized specific and aggregate stop-loss rates uniquely reflecting your managed care capabilities. We have a flexible policy with numerous product options. We deliver excellent service in all regards, including underwriting, proposal turnaround time, premium, claim, and contract administration.

We use Companion Life Insurance Company, an A+ rated carrier, as the insurance company providing specific and aggregate stop-loss protection. You may use your own TPA or contract with a TPA in the local market.

Summit Re can offer your sales and marketing staff a turnkey stop-loss program using Companion Life Insurance Company policy forms. Alternatively, we can work with you to use your own insurance company paper if available. Consulting services are available to help you place the business, to underwrite cases and to develop pricing and underwriting guidelines as well as manual rates.

Reports Help You Manage Costs

Important trends in your claim experience as well as potential utilization of appropriate managed care programs through Summit Re are available through our extensive management information reporting package. In addition to routine reinsurance claim explanations of benefits (EOBs), Summit Re offers a variety of claim reports regarding turnaround time, diagnosis and managed care vendor utilization savings.