Summit Reinsurance Services, Inc. announced a strategic collaboration with Renalogic, a solution provider offering risk management services for kidney disease. Renalogic uses a data-driven approach focused on predicting and preventing chronic conditions that lead to dialysis.

Read moreSpecialty Pharmacy Services Collaboration with AscellaHealth

Summit Reinsurance Services, Inc. announced a strategic collaboration with AscellaHealth, a pharmacy benefit manager offering innovative specialty drug programs developed as specialized solutions to the biggest drivers of pharmacy claims.

Read moreAre You Ready? Preparing for Gene and Cell Therapies Coming Down the Pipeline

Gene and cell therapies can be life changing but come with expensive price tags. As more therapies are FDA approved, payers are looking for options to control the spiraling cost of specialty pharmacy and to project future financial risk related to new therapies coming to market.

Read moreGene Therapy for Hemophilia A: Valrox may be the world’s most expensive one-time treatment

Should it be approved, BioMarin is considering pricing Valrox, a gene therapy drug aimed at hemophilia A, at $2 million to $3 million for the single treatment.

Read moreZolgensma and Gene Therapy: What is the Cost?

Gene therapy in healthcare has become a reality, and it is set to move from a trickle to a stream in the next few years. This article discusses Zolgensma and other emerging gene therapies in the context of how they may affect a health plan’s costs.

Read moreSummit Re Announces Collaboration with Deerwalk, Inc.

Summit Reinsurance Services, Inc. today announced a strategic collaboration with Deerwalk, Inc., an innovative population health management, data management, and healthcare analytics software company. Through this collaboration, Summit Re clients will have access to the most complete population health management suite in the industry. Efficient and accurate data collection, intake, enrichment, and reporting, will allow participating clients to obtain a full picture of their risk portfolio in order to make more effective management decisions.

Read moreSummit ReSources 2018 Outcomes

Summit ReSources helped clients realize more than $30 million in savings for 2018.

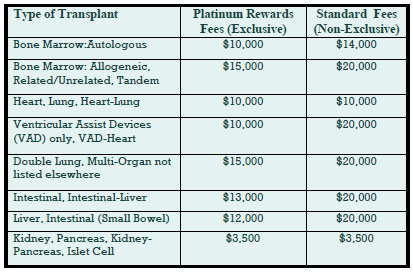

Read moreDeep Discounts on Transplant Program Fees

Deeply discounted transplant access fees are available through our new Platinum Rewards program, an enhanced OptumHealth Care Solutions (formerly United Resource Networks) program. This program is available only to Summit Re’s clients. Under our previous program, you received a 5% discount on network access fees, an additional 5% discount if you agreed only to use OptumHealth’s networks, and up to 10% based on Summit Re’s total volume of business with OptumHealth. The third discount was calculated retrospectively.

These three potential discounts are now bundled into one substantial discount. The program is easier to use and easier to understand. You will be able to realize the total savings we've negotiated “up front” through reduced access fees.

The savings from the Platinum Rewards program can be significant, as shown in the chart. Based on our historical case mix, the Platinum Rewards program represents an effective 27% discount off standard OptumHealth fees.

To be eligible for Platinum Rewards, you must agree only to use the OptumHealth networks for your transplants, although you can still “carve out” facilities with which you have your own contracts.

The new program is effective on January 1, 2008. You will need to execute a new Payer Access Agreement, selecting either the fees for the Platinum Rewards program or the standard access fees.

Platinum Rewards Frequently Asked Questions

Which of the OptumHealth programs will be subject to the reduced fees?

The reduced fees apply to the Transplant Resource Services’ Centers of Excellence program and the Transplant Access Program for business that is reinsured through Summit Re. All other OptumHealth program fees remain unchanged.

Do the reduced fees apply to both adult and pediatric transplants?

Yes, the reduced fees apply to adult and pediatric transplants.

How will the Platinum Rewards program affect the OptumHealth transplant facility contracts and services?

The new program has the same facility contracts and services contained under the current OptumHealth programs.

Will I be able to “carve out” a specific facility from the OptumHealth contract and use my own contract at that OptumHealth facility?

You will still have the capability of carving out a facility or facilities from the OptumHealth agreement. Those facilities should be listed on Exhibit C of the Payer Access Agreement.

What happens if I want to use another transplant network in addition to OptumHealth?

You may use another network in addition to OptumHealth. However, if you do so, you will not be eligible for the reduced fees available through the Platinum Rewards program. You will pay OptumHealth’s standard access fees.

What do I need to do to initiate the new program?

If you are currently accessing OptumHealth through Summit Re, you will need to sign a new Payer Access Agreement. New Payer Access Agreements will be mailed to Summit Re clients. Be sure to indicate if you intend to use the OptumHealth network only or if you will use another network in addition to OptumHealth’s network.

Will I still receive this year’s discount based on Summit Re’s total volume of business with OptumHealth?

You will still be eligible for the discount for 2007 based on Summit Re’s total volume of business with OptumHealth, provided you are a Summit Re client at the time the refund is paid. OptumHealth has committed to paying this refund within 60 days after the end of the calendar year.

Goal: Reduce Inpatient Admissions

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. You may be aware of Summit ReSources' consultative case management and managed care programs, but what you might not know is that our Managed Care Specialist is available to perform an in-depth assessment of your own medical management practices and procedures. This helps you ensure that your medical management is effective and efficient, not only for the benefit of your bottom line, but it also may ensure optimal outcomes for your members.

Goal: Reduce Admissions

ABC Health Plan recently contracted with Summit ReSources’ Managed Care Specialist to perform an evaluation of its medical management department. The overall goal of the health plan was to shift away from intense inpatient utilization management and focus on outpatient case management. In other words, the health plan recognized the importance of implementing steps to prevent the inpatient admissions in the first place.

On-site Evaluation

An on-site evaluation included staff interviews and assessments of policies, procedures, processes, and computer systems. Some of the issues addressed included:

- Are the health plan’s policies and procedures consistent with the NCQA standards?

- Are staffing patterns consistent with national benchmarks?

- What is the most cost-effective way to perform utilization management?

- What are appropriate outcome measures for medical management?

- What key features should be included in a disease management program?

- Which members should be referred for disease and case management?

- What are appropriate measures for return on investment for disease management and case management?

- What key features should be included in a predictive model?

Recommendations

Recommendations were made related to maintaining only the utilization management process that would provide the greatest clinical and financial value to the organization.

Since ABC Health Plan did not have a well-developed case management program, specific recommendations for the development of such a program were provided, including but not limited to, examples of case management referral triggers, screening tools, acuity measures, and return-on-investment documentation.

Post evaluation, there were several additional phone conferences regarding implementation of the recommendations.

The feedback from ABC Health Plan was that the assessment and recommendations were “crucial” and “most helpful” in moving the process forward to meet the overall goals of the organization.

Summit ReSources is available to provide an evaluation of your medical management program. Whether you are a small or large managed care organization, eliciting an outside evaluation of your medical management efforts can be beneficial. Summit Re works with efficient, cost-effective health plans, but most understand the need for continual improvements in medical management given the rapid changes in health care.

Managing NICU Costs

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. Neonatal intensive care unit (NICU) costs, especially for managed Medicaid populations, are one of the top drivers of overall healthcare costs for health plans. The major reasons for the high NICU costs are a significant variability in NICU care patterns, continuous advances in NICU care which is often reflected by higher cost of care, and longer lengths of stay as premature infants are born younger and surviving, albeit with more complex care needs. So what is a health plan to do?

Summit ReSources, the Summit Re managed care department, works closely with The Assist Group, an NICU management company that provides care management, forensic hospital bill audits and a new service called EvalAssist.

Situation: Increase in NICU costs

One of our clients, ABC Health Plan, experienced a significant increase in NICU costs over the last 2 years without a corresponding increase in membership. Summit ReSources recommended that ABC Health Plan consider contracting with The Assist Group for EvalAssist. After an initial conversation with The Assist Group, ABC Health Plan decided to move forward with EvalAssist.

On-site assessment

The Assist Group provided an on-site assessment of ABC Health Plan's NICU medical management processes and staffing, NICU facility and professional contracts, and claims submission and payment processes. The Assist Group also provided care management services to several cases referred to The Assist Group by ABC Health Plan.

Over the course of several months, the staff of The Assist Group worked closely with ABC Health Plan to analyze claims data for the past two years and compare the billing patterns to the facility and provider contracts. The Assist Group neonatologists worked directly with the attending neonatologists to discuss the optimal treatment plans for cases referred to The Assist Group for care management oversight. The Assist Group also provided benchmark data regarding lengths of stay based on gestational age and birth weight.

Recommendations

After approximately 3 months, The Assist Group revisited ABC Health Plan to discuss the comprehensive assessment and provide recommendations to maintain or improve the NICU management while decreasing overall cost of care. The overall increase in cost that ABC Health Plan experienced over the last two years was determined to be related to several factors. The Assist Group identified each factor and made recommendations to improve financial outcomes while maintaining quality of care.

Changes

After the key factors for rising overall costs were identified, ABC Health Plan implemented the recommended changes. The Assist Group met with the attending neonatologists to discuss standards of NICU care, worked with ABC Health Plan’s provider contracting department to revise contracts as needed, and assisted the claims department in development of a forensic claims review process prior to payment of the claims.

NICU management has become costly and complex. If you are experiencing rising NICU costs and want to understand the reasons, it is sometimes cost effective to have an outside consultant, who is experienced in all aspects of NICU care, review your processes and possibly identify some factors that would make a difference in your bottom line.