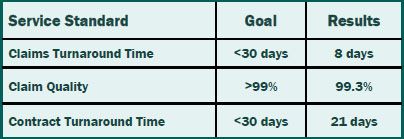

We set standards for ourselves so you can reap the benefits of timely and accurate service. Our claims and contracts staff prides themselves not only on meeting the service standards, but also consistently exceeding the standards.That means you can rely on timely and accurate service from Summit Re so you can concentrate on your business without worries about your reinsurance.

Best of Both Worlds: Self-Funding and Managed Care

To control the rising costs of providing a medical benefit program, some employers look to self funding. HMOs that can offer administrative services only (ASO) or affiliate with third party administrators (TPAs) can bring both a self-funded approach and managed care programs to employers.

Selecting an MGU

HMOs who participate in the employer stop loss market should carefully select a managing general underwriter (MGU) with expertise in both managed care reinsurance and the self-funded market. Your MGU should also have full-service capabilities. Summit Re is a full-service MGU focusing on HMOs who participate in the employer stop loss market. Our managed care experience sets us apart from traditional employer stop loss carriers and managing underwriters.

Pricing and Underwriting

Summit Re’s staff of underwriters and actuaries is dually equipped to understand this combination of funding and managed care savings. We apply our knowledge in the development of competitive stop loss rates and aggregate funding factors for your self-funded clients. As one of the market leaders in HMO excess reinsurance, we have a unique understanding of HMOs and their excess medical risk. We review not only your provider contracts, but also your managed care protocols and your HMO experience.

Sales Support

Summit Re takes an active role in helping you place self-funded business. We are a phone call away to discuss strategy on individual accounts. In unique situations, we can assist you in the on-site presentation of the stop loss proposal to the employer. Once a group is sold, we focus on servicing the account.

Integrated Administration

Our rating and proposal system is fully integrated with our stop loss contract production, premium collection, and claims payment modules. This results in proposal-based policy issued quickly, accurate premium accounting, and timely claim payments. We also have an experienced staff in each functional area to ensure that personalized service isn’t forgotten.

Risk Transfer Flexibility

Summit Re works with two carriers who provide the employer stop loss product: Companion Life Insurance Company and Presidential Life Insurance Company. These two carriers allow Summit Re to write this product in all 50 states.

If you want to retain some of the risk but do not have an insurance company, there are certain approaches we can use that allow you to assume a portion of the risk written by one of our insurance company partners and managed by Summit Re.

If you have an insurance company to write the employer stop loss product, your carrier can keep some or all of the risk. Summit Re can provide some or all of the MGU services, or your insurance company can perform all the functions with Summit Re providing consulting services in specific areas.

Summit Re’s goal is to be creative, responsive and entrepreneurial, to help you meet your strategic goals for employer stop loss, whatever they may be!

Reinsurance Report Card: Does your reinsurer make the grade?

It’s that time of year again, time to review and renew your reinsurance coverage. You may be tempted to select the lowest price per covered life. You may be tempted to do nothing and avoid the disruption of changing reinsurers. You may be tempted to forgo reinsurance altogether. After all, bottom line, how much difference could it make? There are sound financial reasons to reinsure; if you purchase the wrong coverage or select the wrong reinsurer for your needs, your plan will suffer the financial consequences.

Why reinsure?

Before we explore an unbiased way to compare reinsurance quotes, you first must decide if you even need reinsurance. The goal of reinsurance is to remove volatility from your financial statement by replacing a highly variable cost with a relatively stable cost.

► Purchase reinsurance to control unpredictable risks—unpredictable costs, unpredictable utilization or both. This applies to any benefits, including drugs.

► Purchase reinsurance to cover potential catastrophic claims, whether you define it as a $100,000 or a $500,000 claim.

► Purchase reinsurance if the risk is not likely to be minimized by provider contracting, case management and/or Centers of Excellence network. Can you capitate or contract very tightly for a risk?

► Purchase reinsurance for insolvency coverage, conversion access, access to COEs or other services that are either not available elsewhere or the reinsurer has better terms than you can get directly.

Reinsurance Report Card

If you need reinsurance to reduce the financial volatility of your plan, the Reinsurance Report Card gives you an objective method for comparing reinsurance options. It is a standard approach to evaluate competing reinsurance proposals based on what is important to you, not what is important to the broker, MGU or carrier. It enables you to make the best value decision, which may not be obvious from just the price.

The Reinsurance Report Card addresses four general categories: Price, Coverage, Service and General.

Using the Report Card

Assign Weights

Start by assigning weights according to the needs of your plan to each criterion within a category to create a weighted grade for that category. Then assign relative weights to each category based on how important that category is to your decision. Use the same weighting scheme for every proposal you evaluate.

Assign grades to each criterion

For each criterion, assign a grade from 1 to 10 with 10 being the best. If you don’t know how to grade a reinsurer for a heavily weighted criterion, you can use the Report Card to ask critical questions and probe to make sure you understand the proposal.

Calculate the final grade

Multiply the grade for each criterion times the weight for the weighted grade. Add the weighted grades for a category subtotal. Multiply the category subgrades times the weight for the category and total the weighted category grades for the final grade.

Price—a place to start

When evaluating reinsurance proposals, it is natural to start with the price since you want the best value for your money. Reinsurance should replace a highly variable cost with a relatively stable cost. Price is a key factor in this decision and here are some things to consider when evaluating price.

Reasonable and understandable?

Is the pricing reasonable and understandable? If the price looks too good to be true, then it probably is. If you have creditable claim experience or data, then you know if the price is reasonable for the risk. Ask how the price was derived to determine if it is reasonable. If the price isn’t reasonable for an initial quote, then you need to be concerned about consistency.

Consistency

A consistent pricing and underwriting philosophy results in relatively stable cost of reinsurance which, in turn, helps stabilize your financial results. You don’t want your cost of reinsurance to fluctuate with your catastrophic claim experience. If you have one bad year, reinsurance rates should not double or triple. Find out if the reinsurer bases experience on multiple years, that are then blended with manual rates. The purpose of reinsurance, after all, is to absorb the bad years to smooth your financial results. If your reinsurance costs simply follow your claim experience, then it is not performing as intended.

If you receive a quote that is dramatically lower than the other quotes, everything else being equal, should you take the low price as long as it lasts? Plans that frequently change carriers, always chasing the lowest annual cost, may eventually discover carriers quoting with higher rates to  anticipate the short term nature of the business relationship. Some carriers may even refuse to quote.

anticipate the short term nature of the business relationship. Some carriers may even refuse to quote.

Alternative funding

Occasionally you may receive a quote for an alternative funding option, such as swing rates, minimum and maximum rates, or split funding where you retain a percentage of the premium. Creativity in pricing structures is good, but it must have real meaning. One valid reason for alternative funding is when the risk is so new that the reinsurer cannot anticipate and price for the experience. Be on guard, though, if it appears the reinsurer is just playing with the coverage. Flat rates are the norm and often these alternative structures are designed to give the appearance of low rates, without providing the protection expected. Question any quote that is significantly lower than expected, because you may not be getting the coverage you need to reduce financial volatility.

Coverage Terms—what are you getting for your money?

To get good value for your reinsurance dollar, you need to carefully review what is covered. Reinsurance will reduce financial volatility only if the terms cover the risk of a few unpredictable catastrophic claims.

Medical services

To determine which medical services should be reinsured, start by reviewing your large claim exposure history. Then determine how new risks (technology, drugs and treatment), changes in networks, and new lines of business will affect your future large claim exposure.

Once you have decided which services may result in high cost claims, your next decision is whether to contract or reinsure the risk. How well will provider contracting or managed care programs handle the risk versus reinsurance? Keep in mind that some reinsurers assist with provider contracting and managed care programs. Determine if the reinsurer provides special coverage, or carveouts, for a specific risk, such as first dollar quota share of NICU claims. Alternatively, is there a specific risk that you want to retain because of your ability to manage the care? Then perhaps you do not need reinsurance coverage for that risk.

How well does your reinsurer help you understand the adequacy of your coverage terms compared to your risk exposure?

Appropriate deductible

A sound rule of thumb for an appropriate deductible, regardless of the size of your plan or your lines of business, is to set the deductible so it generates between 5 to 15 claims per year. The number of large claims is a good measure of unpredictability. If you typically have fewer than five reinsurance claims, your plan is assuming too much unpredictable risk. If you average more than fifteen reinsurance claims, your plan may be dollar trading with the reinsurer for predictable claims; you are paying a profit margin to the reinsurer on claims that you should be retaining.

Are you adjusting the deductible for medical inflation? Due to leveraged trend, medical inflation is higher on catastrophic claims.

Is your deductible appropriate for your surplus situation? Before setting your deductible, determine the risk tolerance of your company. If you are not strong financially or do not have ready access to capital, you need more reinsurance.

Are you adjusting your deductible for changes in membership levels? As you write more members or lose members, remember to change your deductible to keep within 5 to 15 reinsurance claims per year. If your membership decreases, lower your deductible; if your membership increases, increase your deductible.

Impact of limits

Are you aware of what isn’t covered by reinsurance which may increase the volatility of your financial results? For example, infusion drugs may be generating large claims and not be covered by reinsurance.

Is your reinsurance efficient? At least 75% of the claims above your deductible (excluding coinsurance) should be covered by the reinsurance agreement each year for the past three years. What appears to be a great reinsurance rate may simply reflect low daily inpatient maximums or other limits. Check the market for better coverage for your reinsurance dollar.

Are a particular facility’s claims being cut back? For example, you may have a significant number of claims at a local university hospital or children’s hospital at a higher cost than other facilities, and these claims are cut back by your reinsurer. Consider purchasing better coverage for that facility.

Are separate limits applied? Daily limits should not apply to case rates or DRG contracts except for outliers. Some reinsurers still apply a daily maximum even if there is a case rate, which isn’t appropriate. This reduces your reinsurance cost but does not reduce the financial volatility of your plan.

Reinsurer definitions

Are “medical” definitions even necessary in a reinsurance contract? If the reinsurance contract uses your plan’s definition, you are assured that an outside party will not be second guessing your medical decisions. Reinsurance coverage should be predictable in order to protect you from unpredictable financial implications.

If your reinsurer believes that its own definitions are necessary, do you understand how they are applied and how they differ from your plan’s definitions? Do you understand the process for resolving differences in opinion regarding:

- Medical necessity

- Experimental treatment

- Usual and customary

- In lieu of inpatient hospitalization

- Acute care

Suppose you determine that a bone marrow transplant is medically necessary for a claim, but your reinsurer decides it is not medically necessary. This usually results in a battle between medical experts—a waste of resources for everyone. Prevent this with reinsurance coverage that covers what you cover.

If a treatment is questionably experimental, it is almost always costly and a reinsurance claim; for example, a small bowel transplant in a baby is considered experimental by some reinsurers. You purchase reinsurance to cover high-cost, unpredictable claims, not to argue about experimental treatment.

Usual and customary can set arbitrary limits, so you cannot be assured of reinsurance reimbursement. This usually applies to physician fee schedules, but sometimes a usual and customary limit will be applied to inpatient costs based on an average cost for area. Normally the definition of usual and customary is not clearly worded so you don’t know exactly how it will be applied. Therefore, why should such a definition even be in a reinsurance contract designed to reduce volatility?

Some reinsurers offer to cover step-down care “in lieu of” inpatient care, typically if only inpatient services are covered by reinsurance. While managing care to a lower level of intensity usually makes sense both in terms of recovery time and cost, the concept is increasingly difficult to apply. Often nursing notes and hospital files are required to demonstrate the care was truly “in lieu of” acute hospital care. To avoid problems, look for a standard reinsurance benefit for drop down facilities.

What is acute care and what is chronic care? This can be a gray area with legitimate disagreements between qualified medical experts. Where does a particular claim fall on the continuum of care scale? You should be able to make a qualified medical decision without concern that there is a different definition in your reinsurance agreement.

Reinsurance Claims and Premium Service Standards

As you evaluate your reinsurance options, keep in mind the industry standards for claims and premiums. These are quantitative standards that are easily measurable and this is the level of service you can reasonably expect.

Claims turnaround—less than 20 business days.

Claims accuracy—99% or better.

Expected reimbursement

Are you reimbursed what you expected 95% of the time? What is the process for resolving claims disputes? Is there a good working relationship with the reinsurer’s claims department? Is its claim audit process acceptable?

Reporting—You should expect quarterly claims reports and quarterly managed care savings reports.

Electronic processing—Does your reinsurer process both premiums and claims electronically? This should be a standard procedure.

Contracts and General

Treaties to client—within 30 business days of signed binder. Since treaty terms are so critical to the value of your reinsurance coverage, it is important to have the treaty to review within 30 days after negotiating the purchase in order to quickly resolve any issues.

New customer installation—within 30 days of coverage effective date. Installation should involve financial, administrative and medical management staff. The first step is the administrative aspects of installation for premium payments and claim submissions; second, the contract treaty terms; and third, setting up managed care programs.

Reinsurance rep visits in person—at least twice a year. While there is nothing wrong with an occasional golf game, visits should be meaningful and provide real value to you. Does your rep understand your strategies? Share industry trends? Offer solutions? Does your reinsurer’s managed care, administrative and claims people visit as needed?

Consultative care management services available

You should reasonably expect your reinsurer to provide large claim advice, support, and research. Does your reinsurer initiate the contact as a result of receiving a 50% notice on claims?

Managed care vendors—Does your reinsurer provide access to a portfolio of attractive managed care vendors at preferred pricing?

Reinsurer source of other product and service solutions

► Employer Stop-loss

► Out-of-area indemnity

► Group life and ancillary products

► High level job referrals

Click here for a PDF version of the full Report Card.

Analyze Your Reinsurance Coverage

Summit Re uses a proprietary coverage analysis tool, called InSight, to give CEOs and CFOs the quantitative decision-making data they need to make informed reinsurance decisions. InSight is designed to ensure that you obtain the most value out of your reinsurance coverage. Please contact your Summit Re regional vice president for a personalized demonstration of this tool which will allow your plan a better understanding of how to structure coverage to ensure its effectiveness.

Avoid Reinsurance Coverage Errors

This top ten list of coverage features that can limit a health plan's reinsurance recoveries is based on our experience in managed care reinsurance and reflected in InSight, our coverage analysis tool.

- Limited coverage for high-cost inpatient tertiary care referrals. Where are the high costs-per-day problems: in network or out-of-network?

- Artificial per diems, case rates or fee schedules that do not reflect actual plan costs.

- Reinsurance deductibles chosen at a level too low, producing too many reinsurance claims with the reinsurers margin built in.

- Inpatient per day coverage limits not mirroring plan underlying average daily costs for high cost claims.

- Purchasing reinsurance on budgetable claims such as professional services versus hospital inpatient-only coverage.

- Reinsuring chronic cases. Again, the reinsurer will build in its margin on a budgetable claim.

- Covering outpatient facility benefits which may have limited value for catastrophic reinsurance.

- Variable coinsurance and its potential for lowering coverage on high-cost out-of-network hospital confinements. Alternatively, coinsurance may vary by inpatient costs per day.

- Reinsurer definitions If the treaty has separate definitions for acute care, medically necessary or experimental treatments, the reinsurer may exclude certain claims that you have paid because of its ability to use its own definitions that may not match your health plans certificate of coverage.

- Alternate funding programs These complex programs are another way for a reinsurer to protect its downside risk without giving the plan real risk protection.

To avoid reinsurance coverage errors, contact us today to arrange for a demonstration of the coverage analysis tool. Current clients have a coverage analysis done as a routine part of our annual renewal process.

Compensation—No Double-Dipping

We believe in transparency to the purchaser when it comes to compensation. One can draw the analogy of life insurance financial consultants. They should generally be receiving compensation through fees or commissions, but not both. We earn our fees through our contractual relationship with ERC. We do not load in (and never have) any compensation for transplant networks or other managed care services offered as part of the reinsurance coverage claim reimbursement. You may inquire if other managing underwriters have any such hidden managed care service fees or if brokers have any contingent commission arrangements on your funds. You have the right to know because it's your money!

Buy Direct or Use a Middleman?

Are you contacted relentlessly by reinsurance brokers? We believe in marketing directly to our customers, rather than through a middleman. The advantages of direct marketing include:

- Direct contact with you enables us to do our own risk analysis to best match excess coverage to a plans needs and objectives. This direct interaction is particularly important due to complex product structures and your evolving needs.

- Field underwriting gives us a thorough understanding of the risk that you are assuming, rather than relying on a middleman for critical information.

- Understanding your unique strategies and having direct contact with your management allows us to match other products and services to your plans needs.

- Expense management is needed for long-term survival in a competitive managed care market. A typical broker commission adds 10 percent to premium costs.

Summit Re/GE Insurance Solutions is one of four major providers of HMO excess loss coverage, defined as carriers with over 10% market share each. Two of the four top reinsurers market directly. This means that if you use a broker and don't also access the direct markets like Summit Re independently of your broker, you will miss quotes from half of the major reinsurers. Certain brokers may even be unable to access some broker markets because they have no relationship with the carrier. This reduces the broker's reach even further.

If you do use a broker, nothing stops you from accessing the expertise of Summit Re, as well. If you give us a chance to help you, you won't be disappointed.

Summit ReSources: Complement Your Managed Care Programs

Catastrophic managed care programs need to complement rather than replace your programs. Summit Re and GE Insurance Solutions are dedicated to providing you protection from catastrophic claims. Together, we designed Summit ReSources, a program of managed care services whose goal is to bring value and service support in your management of catastrophic risk. In most situations, the managed care expenses of vendors are treated as an eligible claim expense by ERC. Our website (www.summit-re.com) has a complete listing of the programs which are available.

Add Lives Under Management with Employer Stop-loss

Many employers turn to HMOs and other strongly managed care programs to control healthcare costs, while others look to the cost-control aspects of self-funding. HMOs that can offer administrative services to self-funded employers bring the best of both worlds. To take advantage of this opportunity and to increase your lives under management, you need actuaries and underwriters equipped to understand this combination of funding and managed care savings. Summit Re's level of managed care experience sets us apart from others in the self-funded marketplace that experiment in the managed care world.

Key strengths that we bring to you include our ability to analyze managed care networks and develop customized specific and aggregate stop-loss rates uniquely reflecting your managed care capabilities. We have a flexible policy with numerous product options. We deliver excellent service in all regards, including underwriting, proposal turnaround time, premium, claim, and contract administration.

We use Companion Life Insurance Company, an A+ rated carrier, as the insurance company providing specific and aggregate stop-loss protection. You may use your own TPA or contract with a TPA in the local market.

Summit Re can offer your sales and marketing staff a turnkey stop-loss program using Companion Life Insurance Company policy forms. Alternatively, we can work with you to use your own insurance company paper if available. Consulting services are available to help you place the business, to underwrite cases and to develop pricing and underwriting guidelines as well as manual rates.