Summit Reinsurance Services, Inc. today announced a strategic collaboration with Deerwalk, Inc., an innovative population health management, data management, and healthcare analytics software company. Through this collaboration, Summit Re clients will have access to the most complete population health management suite in the industry. Efficient and accurate data collection, intake, enrichment, and reporting, will allow participating clients to obtain a full picture of their risk portfolio in order to make more effective management decisions.

Read moreTransplantation and Expanded Criteria Donors: Hepatitis C

This shortage of available organs has led to the increased use of Expanded Criteria Donors in transplant centers for many different organs. This article discusses liver transplant recipients who are hepatitis C negative and receive a liver from an expanded criteria liver donor who is Hepatitis C positive.

Read moreSummit ReSources 2018 Outcomes

Summit ReSources helped clients realize more than $30 million in savings for 2018.

Read moreDeep Discounts on Transplant Program Fees

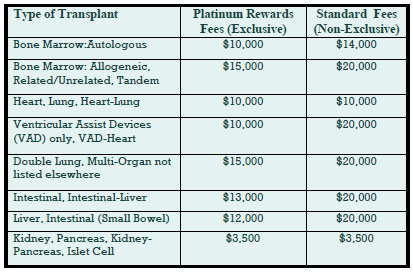

Deeply discounted transplant access fees are available through our new Platinum Rewards program, an enhanced OptumHealth Care Solutions (formerly United Resource Networks) program. This program is available only to Summit Re’s clients. Under our previous program, you received a 5% discount on network access fees, an additional 5% discount if you agreed only to use OptumHealth’s networks, and up to 10% based on Summit Re’s total volume of business with OptumHealth. The third discount was calculated retrospectively.

These three potential discounts are now bundled into one substantial discount. The program is easier to use and easier to understand. You will be able to realize the total savings we've negotiated “up front” through reduced access fees.

The savings from the Platinum Rewards program can be significant, as shown in the chart. Based on our historical case mix, the Platinum Rewards program represents an effective 27% discount off standard OptumHealth fees.

To be eligible for Platinum Rewards, you must agree only to use the OptumHealth networks for your transplants, although you can still “carve out” facilities with which you have your own contracts.

The new program is effective on January 1, 2008. You will need to execute a new Payer Access Agreement, selecting either the fees for the Platinum Rewards program or the standard access fees.

Platinum Rewards Frequently Asked Questions

Which of the OptumHealth programs will be subject to the reduced fees?

The reduced fees apply to the Transplant Resource Services’ Centers of Excellence program and the Transplant Access Program for business that is reinsured through Summit Re. All other OptumHealth program fees remain unchanged.

Do the reduced fees apply to both adult and pediatric transplants?

Yes, the reduced fees apply to adult and pediatric transplants.

How will the Platinum Rewards program affect the OptumHealth transplant facility contracts and services?

The new program has the same facility contracts and services contained under the current OptumHealth programs.

Will I be able to “carve out” a specific facility from the OptumHealth contract and use my own contract at that OptumHealth facility?

You will still have the capability of carving out a facility or facilities from the OptumHealth agreement. Those facilities should be listed on Exhibit C of the Payer Access Agreement.

What happens if I want to use another transplant network in addition to OptumHealth?

You may use another network in addition to OptumHealth. However, if you do so, you will not be eligible for the reduced fees available through the Platinum Rewards program. You will pay OptumHealth’s standard access fees.

What do I need to do to initiate the new program?

If you are currently accessing OptumHealth through Summit Re, you will need to sign a new Payer Access Agreement. New Payer Access Agreements will be mailed to Summit Re clients. Be sure to indicate if you intend to use the OptumHealth network only or if you will use another network in addition to OptumHealth’s network.

Will I still receive this year’s discount based on Summit Re’s total volume of business with OptumHealth?

You will still be eligible for the discount for 2007 based on Summit Re’s total volume of business with OptumHealth, provided you are a Summit Re client at the time the refund is paid. OptumHealth has committed to paying this refund within 60 days after the end of the calendar year.

Managing Capital Through Reinsurance

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. Summit Re works with London Life Reinsurance Company to provide reinsurance transactions that achieve risk-based capital (RBC) relief for qualified prospects.

Benefits

There are several potential benefits resulting from such reinsurance transactions:

- Proper capital and surplus management can improve debt and claim paying ratings.

- Reducing required capital requirements increases business line return on equity.

- Dividend capacity can be improved for entities with holding company structures.

- Individual plan or product line loss ratios can be stabilized for external understanding.

- New business can be more competitively priced.

These programs can be developed for single-site organizations as well as regional and national chains. They can be designed easily for entities that have affiliated domestic or offshore companies. However, they also can work with a nonowned, protected-cell approach. All programs are structured to meet applicable risk-transfer regulations. Solutions are customized to meet each company’s specific objectives and requirements.

Case Study

Here’s an example of one of our clients' capital management programs developed through its relationship with Summit Re:

ABC Health Plan is a regional health plan. Its business is ceded to London Life via a 100% quota share above the HMO’s retention level. London Life, in turn, retrocedes the business on the same terms to a captive affiliate of ABC Health Plan. The transaction is designed to meet all regulatory requirements for full risk transfer and credit for reinsurance. In addition, the transaction has been disclosed to the insurance department of the state of domicile of ABC Health Plan.

Regulators often prefer or require independent professional reinsurers as the conduits for such transactions to minimize the potential for improper related-party transactions. The state insurance department in this case relied on the financial strength of the licensed and authorized professional reinsurer to fulfill its reinsurance obligations to ABC Health Plan. ABC Health Plan’s holding company is free to establish appropriate GAAP reserves and equity consistent with sound actuarial principles and subject to the reserve and capital requirements of the domicile of the captive.

Health RBC Relief Structure in Brief

The typical structure is modified coinsurance or coinsurance with funds withheld to minimize asset transfer. The only cash flow is your payment of the risk fee.

Reserves are held in asset trust by the reinsured.

There is parental guaranty on the retrocession treaty, if retrocession is used.

All profits, net of risk fee, are returned to you through an experience refund.

There is monthly accounting.

The health risk-based capital relief structure has the following risk reducing features:

- Expense allowances set about equal to “marginal” expenses.

- Losses to reinsurer are carried in loss carryforward and repaid through future profits. Ceding company must repay any losses if it terminates agreement early.

- Loss to reinsurer usually limited by stop loss (typically 10% of premium).

- Reinsurer can terminate agreement with minimum notice (usually 3 months).

- Allows ceding company to release RBC requirement on business ceded.

- Designed to pass required level of risk to reinsurer to meet risk transfer regulations.

- Minimizes the cost of reinsurance to the ceding company (1% of premium or less).

Cover transplants from first dollar

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. A typical HMO excess coverage provides risk protection for all catastrophic events—traumas, transplants, neonatal cases, and other complex medical claims. Some plans, however, prefer to "carve out" certain risks from their medical excess coverage and have specific coverage for the given risk on a first dollar basis. Organ and bone marrow transplant carve-out coverage is such an example.

The need

ABC Health Plan is a public hospital board authorized by statute to operate a hospital service plan in its state. Because the plan desired predictability and the plan's hospital owner is not a major tertiary provider for organ transplants (excluding kidneys), the plan was interested in having organ transplants carved out from its risk.

The solution

Summit Re provided ABC Health Plan an organ transplant carve-out through United HealthCare Insurance Company, part of OptumHealth Care Solutions’ (formerly United Resource Networks) family of transplant programs. Summit Re still provides the medical excess coverage to ABC Health Plan in excess of its $90,000 deductible with an appropriate credit for the organ transplant carve-out now reinsured by United.

The result

ABC Health Plan has renewed the program for several years with predictable renewals and has access to excellent organ transplant case management and provider contracts. A typical premium for this type of coverage is $2.00-$4.00 per member per month, depending on the parameters of the risk.

Coverage details

Covered organ transplant procedures include liver, kidney, heart, lung, heart/lung, double lung, pancreas or simultaneous pancreas/kidney. Digestive transplants are covered only when performed by a facility that participates in the transplant network. Coinsurance is higher for services provided by non-network facilities.

Transplant services include all medically necessary services resulting from and/or directly related to an organ or bone marrow transplant procedure, including:

- Services provided by the transplant facility

- Hospital or skilled nursing facility services

- Physician services

- Nursing services

- Outpatient treatment and follow-up

- Speech, physical and occupational therapy

- Anesthesia and anesthesia services

- Radiology

- Laboratory services

- Oxygen

- Durable medical equipment

- Blood and blood products

- Dressings

- Harvesting and acquisition expense

- Transportation, lodging and meals for transplant candidate and one companion

Typical services NOT covered include:

- Services received before or after the benefit period, other than services for bone marrow harvesting, transplant evaluation, living donor organ procurement, air ambulance or transportation, lodging or meals related to the covered transplant procedure

- Organ or tissue transplants performed prior to the member’s effective date

- Services not related to the covered transplant procedure

- Services unrelated to the diagnosis or treatment of the transplant procedure

- Drugs that are investigational or have not been approved for general sale by the FDA

- Items which are not medically necessary

“No Floors” Transplant Network

The most important consideration when choosing a transplant network should always be the quality of care delivered. A secondary but important consideration is the cost effectiveness of the network. Contracts for the U.R.N. Transplant Centers of Excellence network and Transplant Access Program (TAP) are structured in a variety of ways, allowing Summit Re customers referral options based on their desire for cost predictability. In order to assist in the contract selection process, U.R.N. has identified a subset of network contracts without floors and aggregated them into a “No Floors” network.

The U.R.N. "No Floors" network consists of programs with transplant contracts that eliminate the possibility of a transplant being paid at a percent of billed charges. This network consists of 51 centers and 237 transplant programs and increases the transparency of network providers without minimum payment provisions. This provides you with greater transplant cost predictability when using a “No Floors” network facility.

Information regarding the “No Floors” network, including a listing of the facilities, can be found on the U.R.N. website (www.urnweb.com) or you can contact Debbie Stubbs, RN, MS, CCM at 260-407-3979 or at dstubbs@summit-re.com.

Case studies from The Assist Group

The Assist Group specializes in solutions for catastrophic claims management and high-risk premature infants. Current products include CareAssist, a unique, physician-driven neonatal care management program, and ClinAssist, a powerful forensic audit and claims resolution service. The Assist Group has a proven track record for delivering financial value to clients. For more information about these products and services, please visit the company's website, www.assistgroup.com, or contact Debbie Stubbs, RN, MS, CCM at Summit Re, 260-407-3979.

CareAssist Success Story: 32 % Reduction in Length of Stay and $163,693 Savings

This twin boy was born at 25 weeks, weighing one pound, eight ounces. His mother used multiple illicit drugs throughout her pregnancy and on the day of delivery. He was on mechanical ventilation and in critical condition when referred to CareAssist on day of life (DOL) 17. This infant was not expected to survive due to his prenatal history, the circumstances of his birth, and extreme prematurity. The CareAssist neonatologist recommended an ethics committee consultation to discuss quality of life issues when it became evident on DOL 30 that he would survive. By then, this infant had the severest form of intraventricular hemorrhage, along with hydrocephaly and porencephaly. He also had severe chronic lung disease (CLD) and remained on mechanical ventilation well past his first month of life. His long-term prognosis was poor.

His final discharge disposition further complicated his clinical status as his mother continued to struggle with polydrug abuse and was considered unsuitable to care for him after discharge. CareAssist consistently recommended early discharge planning to allow a foster family to be trained to care for this infant upon discharge. This timely intervention allowed this baby boy to be discharged appropriately and safely.

Multiple oxygen weaning recommendations were made by the CareAssist neonatologist. This infant was eventually weaned to nasal cannula oxygen on DOL 59 and was discharged on low flow nasal cannula oxygen. This infant’s nutritional status was complicated by his CLD and tendency to tire during feedings secondary to his compromised pulmonary status. The steroids used to help wean him from supplemental oxygen also compromised his ability to gain weight. The CareAssist neonatologist emphasized to the treating team the importance of using high calorie formula and advised early developmental interventions through the use of non-nutritive sucking and OT/PT involvement in nipple training. As a result of these interventions, the infant was nippling all of his feedings at a corrected age of just 35 weeks.

The weekly care oversight by CareAssist for nearly three months ensured consistency in the implementation of this infant’s treatment plan. Due to CareAssist’s oversight, this infant was discharged safely to foster care 39 days earlier than originally anticipated. This resulted in a 32% savings of $163,693.

ClinAssist Success Story: $321,757 Savings

A 110-day confinement at a children’s hospital resulted in total billed charges of $1,287,027. ClinAssist reviewed approximately 10,600 line items of detailed charges. Utilizing the clinical expertise of ClinAssist’s neonatologists and nurses, ClinAssist performed a forensic review of the charges and identified the following exceptions:

- Room and board charges billed at incorrect levels of acuity

- Experimental pharmaceutical therapies

- Supplies and services incorrectly unbundled from the room and board charges

ClinAssist successfully achieved a $321,757 reduction in billed charges after the audit exceptions were presented to the facility. The account balance was adjusted to reflect the facility’s written agreement that the exceptions identified by ClinAssist were not payable charges.

Cost containment and more

Summit Re recently entered into an agreement with National Care Network (NCN) for its medical cost containment services. NCN’s core solutions for out-of-network claims include Fee Negotiations, Supplemental Network Repricing, and Hospital Detail Analysis, a Medicare-based pricing methodology.

Unmet Needs

While NCN had been extremely successful in saving its clients millions of dollars with these products, it realized that neither NCN nor other cost containment companies were doing enough to reduce overall healthcare charges. A new product was needed, a product which would:

- Allow fair reimbursement based on the facility’s costs to provide care

- Benchmark similar facilities reflecting the variances within facility costs

- Use flexible pricing methods to meet clients’ needs

- Recommend pricing that is transparent to the payer, provider and member

Data iSight

After a year and a half in development with Data Advantage, a company NCN acquired in 2005, NCN recently introduced Data iSight to meet all of those needs. Data iSight will generate fair reimbursement recommendations that generate legitimate savings. To do this, Data iSight leverages nationally recognized data sets to enhance provider understanding and acceptance; reviews both the financial and clinical components of a claim; incorporates cost-based awareness; and provides a transparency component for providers, payers and members.

About NCN

NCN, a privately held organization based in Irving, Texas, provides its services to large insurance carriers, self-funded organizations, third party administrators, HMOs, employer groups and reinsurance carriers across the country. NCN has achieved many milestones in its fourteen years of operation, including being the first in its industry to receive the URAC Core Accreditation, establishing HIPAA compliant EDI transactions, developing on-line tools for client access of claim tracking and reporting, and reviewing billions of dollars in medical charges.

NCN provides you with a dedicated team to ensure success in helping you meet your savings objectives. Visit NCN at its website, www.nationalcarenetwork.com, or contact Debbie Stubbs, RN, MS, CCM at Summit Re, 260-407-3979.

But what if you have no transplant contract?

Most health plans have contracts with hospitals or medical centers that perform organ and tissue transplants. And, through Summit Re, clients have access to U.R.N.’s Transplant Resource Networks and Transplant Access Program. Most reinsurance agreements provide more favorable coverage for organ and tissue transplants performed in “approved” facilities than for those performed in "unapproved" facilities. The health plan typically submits its contracted rates to the reinsurer during the underwriting process and the reinsurer determines if the contracts will be “approved” or not.

Standard approach

At Summit Re/Swiss Re, that’s our standard approach as well. We usually provide 90% coinsurance for approved contracts (we use the term “scheduled”) and 50% or 60% for unapproved or unscheduled contracts. We list the scheduled contracts on Exhibit A, part of our reinsurance agreement. We consider U.R.N.’s transplant network facility contracts to be scheduled. Usually those contracts our clients hold directly are also scheduled if they are similar to U.R.N.’s.

A potential problem

But what if a member needs to go to a facility that isn’t part of U.R.N.’s network and with which the health plan has no contract for transplants? When the plan tries to negotiate a rate for that member, how will the plan know how the reinsurer will view the arrangement?

Usually the plan won’t know unless the terms are submitted to the reinsurer for review in advance of the transplant, each and every time such a situation arises. This can be frustrating for the health plan and means additional work for the reinsurer.

Summit’s solution

At Summit Re, we recognized this issue early on and took steps to make things easier for you. We developed another exhibit, Exhibit B, which helps our clients determine their reinsurance overage for unscheduled transplants up front.

We list specific case rates we consider to be scheduled for each type of transplant. We show rates for inpatient hospital services only and rates that include professional services. We show a separate set of rates for children and a set for adults. We include rates for all three types of bone marrow/stem cell transplants – even those performed on an outpatient basis.

If the health plan can negotiate case rates that are equal to or are better than the ones shown on Exhibit B, then the claim is reimbursed at the higher coinsurance level. There’s no need to send anything to us for “approval.” You already know the level of coinsurance that applies.

Not a cap

There’s one more very important point to remember, though. The rates listed on Exhibit B do not represent limits on what we consider to be eligible amounts under the reinsurance agreement. They do not represent caps on case rates. Amounts in excess of the listed case rates are not excluded. If a health plan simply can’t negotiate a rate that is equal to or lower than the Exhibit B rate, it just means the claim would be reimbursed at the lower coinsurance level.

This is just another example of Summit Re’s putting into practice its “fairness” Founding Principle to produce balance sheet stability for you.